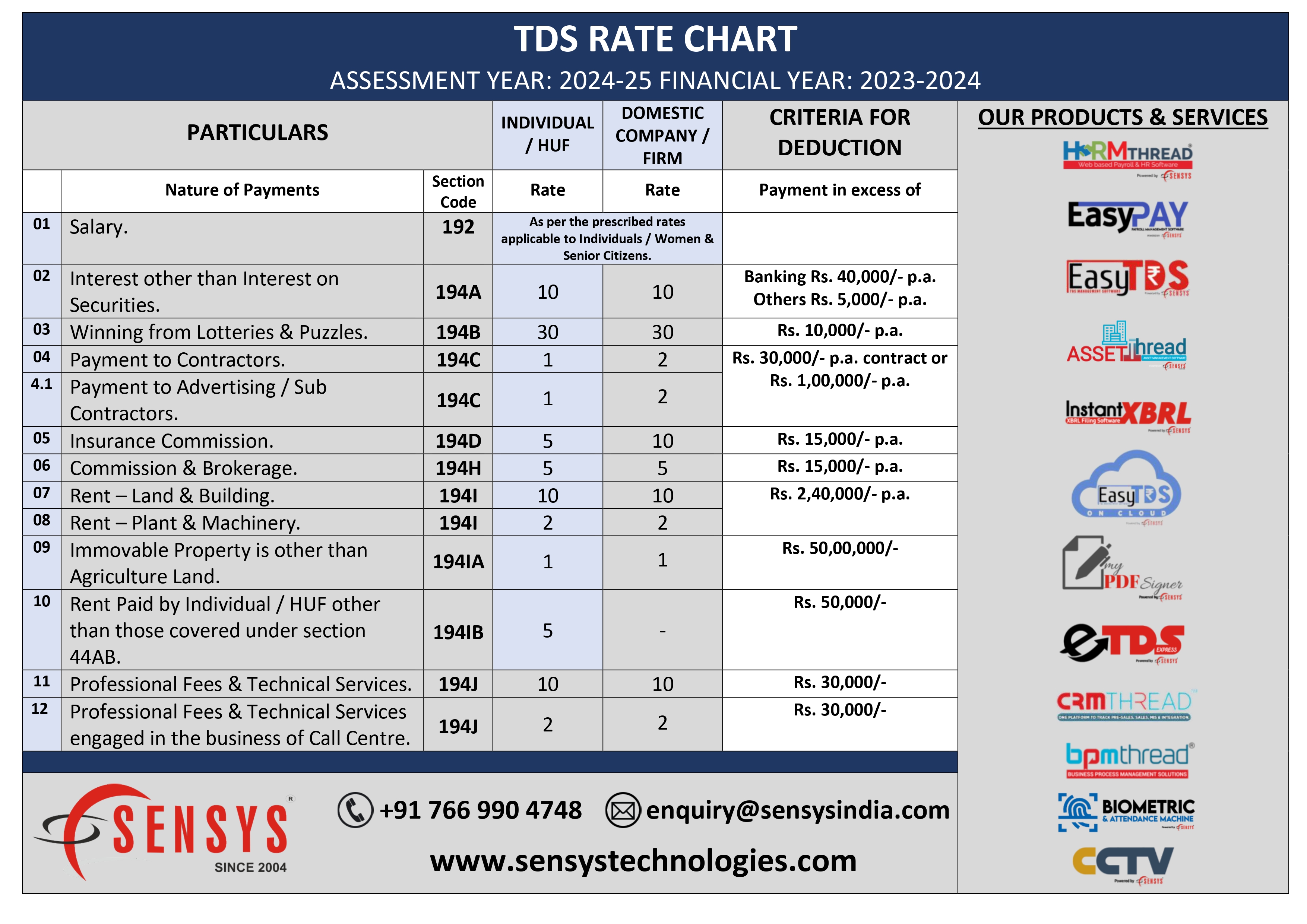

How to compute TDS, when a Employee has exited from the current company and joined a new company in a single financial year

Section 192(2) Where, during the financial year, an assessee is employed simultaneously under more than one employer, or where he has held successively employment under more than one employer, he may furnish to the person responsible for making the payment referred to in sub-section (1) (being one of the said employers as the assessee may, having regard to the circumstances of his case, choose), such details of the income under the head “Salaries” due or received by him from the other employer or employers, the tax deducted at source therefrom and such other particulars, in such form and verified in such manner as may be prescribed, and thereupon the person responsible for making the payment referred to above shall take into account the details so furnished for the purposes of making the deduction under sub-section (1).

Under which circumstances an employee could work under more than employer?

Normally an employee is expected to work under one employer throughout the year. But in circumstances like change in employment in the middle of the year or in case there is shift based payment and employee in working under different employer in different shift or working on part time basis there could be more than one employer in a financial year.

What difficulties arouse when there are more than employers in a year?

In case employee work under more than one employer there is possibility of giving excess benefit of maximum amount not chargeable to tax or deduction being given more than allowed as given in the below diagram:

Employee working under

- Employer 1

- Employer 2

- Employer 3

In the above circumstances all employer might have given employee the benefit of maximum amount not chargeable to tax (Rs. 250000/-) is given by all employers. Hence, TDS might have deducted at lower rate causing a delay in deposit of tax at departmental end and heavy burden of tax with interest to employee at the end of financial year on the other hand.

To prevent this sec 192(2) have introduces form Form 12B which will be given by employee to the employer of this choice so that any one employer have the knowledge of facts of tax being deducted by other employer(s) and correct computation and deposit of TDS taken place.

What are the contents of Form 12B?

Form 12B have following information:

- Name and address of the employee

- Permanent Account No.

- Residential status

- Name and address of employer(s)

- TAN of the employer(s) as allotted by the ITO

- Period of employment

- Particulars of salary as defined in section 17, paid or due to be paid to the employee during the year

- Amount deducted in respect of life insurance premium, provident fund contribution, etc., to which sec. 80C † applies (Give details)

- Total amount of tax deducted during the year (enclose certificate issued under section 203)

- Particulars of value of perquisites and amount of accretion to employee’s provident fund account

The form 12B is employee self declaration and not authentication is required from any of the current / previous employer.

How Form 12A will work?

Where an employee has more than one employer, he is required by section 192(2) to furnish Form 12B to one of the employers the details of salary due / received by him from other employers.

Only after submission of information in form 12B, it becomes the obligation of the employer to deduct TDS after considering the information submitted by Form 12B.

What is the effective date of change is rate of TDS in case employee submitted in Form 12B?

As mentioned above it is only after submission of Form 12B employer is under obligation to alter his rate of TDS deduction.

For example in case Form 12B is submitted in the month of September 2016, only from September 2016 onwards, tax shall be deducted at the average rate determined after considering the details submitted in Form 12B.

Is the present employer is under obligation to declare the details of income earned by employee from previous employment(s) in form TDS certificate also (Form 16)?

No, Form 16 will be issued by each employer(s), including all previous employer(s), normally for income earned by employee from him and tax deducted by him.

Information given in Form 12B is only for the purpose of correct computation of TDS only.

Case study:

Case Study 1 – Employed simultaneously under more than one employer

| Employee Name |

Mr. X |

|

|

|

| Previous Year |

2016-17 |

Assessment Year |

2017-18 |

|

| Employed by |

Salary (pm) |

Total |

|

|

| A Ltd |

|

|

|

|

| Basic Salary |

Rs. 15,000.00 |

|

|

|

| HRA |

Rs. 7,500.00 |

|

|

|

| Conveyance |

Rs. 0.00 |

|

|

|

| Special allowance |

Rs. 7,500.00 |

|

|

|

| Taxable Salary |

Rs. 30,000.00 |

Rs. 360,000.00 |

|

|

| B Ltd |

|

|

|

|

| Basic Salary |

Rs. 20,000.00 |

|

|

|

| HRA |

Rs. 10,000.00 |

|

|

|

| Conveyance |

Rs. 2,000.00 |

|

|

|

| Special allowance |

Rs. 10,000.00 |

|

|

|

| Taxable Salary |

Rs. 42,000.00 |

Rs. 504,000.00 |

|

|

| Total |

Rs. 72,000.00 |

Rs. 864,000.00 |

|

|

| Mr. X has the option to chose any one employer to whom Form 12B be submitted. |

|

|

| If he Chose B Ltd |

Total tax deductible |

|

| case 1 : If employee furnishes Form 12B at the time of appointment: |

|

|

Total tax deductible |

Rate of deduction |

Monthly deduction |

| TDS to be deducted by A Ltd |

|

Rs. 6,180 |

1.72% |

Rs. 515.00 |

| TDS to be deducted by B Ltd |

|

Rs. 94,554 |

18.76% |

Rs. 7,879.50 |

| Case 2 : If employee furnishes Form 12B after one month of his appointment: |

|

|

|

Total tax deductible |

Rate of deduction |

Deduction in 1st month |

Deduction from 2nd month onward |

| TDS to be deducted by A Ltd |

|

Rs. 6,180 |

1.72% |

Rs. 515.00 |

Rs. 515.00 |

| TDS to be deducted by B Ltd |

|

Rs. 94,554 |

18.76% |

Rs. 2,214.50 ** |

Rs. 8,394.50 |

|

|

|

|

|

|

| ** Tax less deducted as employee have not furnished details of previous employer and hence TDS computed only on income given by employer B ltd, i.e., ₹ 5,04,000/- |

Case Study 2 – Successively employment under more than one employer

| Employee Name |

Mr. X |

|

|

| Previous Year |

2016-17 |

Assessment Year |

2017-18 |

| Employed by |

Salary (pm) |

Period of employment |

Total |

| A Ltd |

Rs. 30,000.00 |

9 month |

Rs. 270,000.00 |

| B Ltd |

Rs. 42,000.00 |

3 month |

Rs. 126,000.00 |

| Total |

Rs. 72,000.00 |

12 month |

Rs. 396,000.00 |

| Mr. X has no option but to submit Form 12B to his new employer B Ltd. |

|

| Suppose he submitted Form 12B in his appointing month. |

|

| TDS to be deducted by A Ltd |

Rs. 4,635 |

|

| TDS to be deducted by B Ltd |

Rs. 96,099 |

|