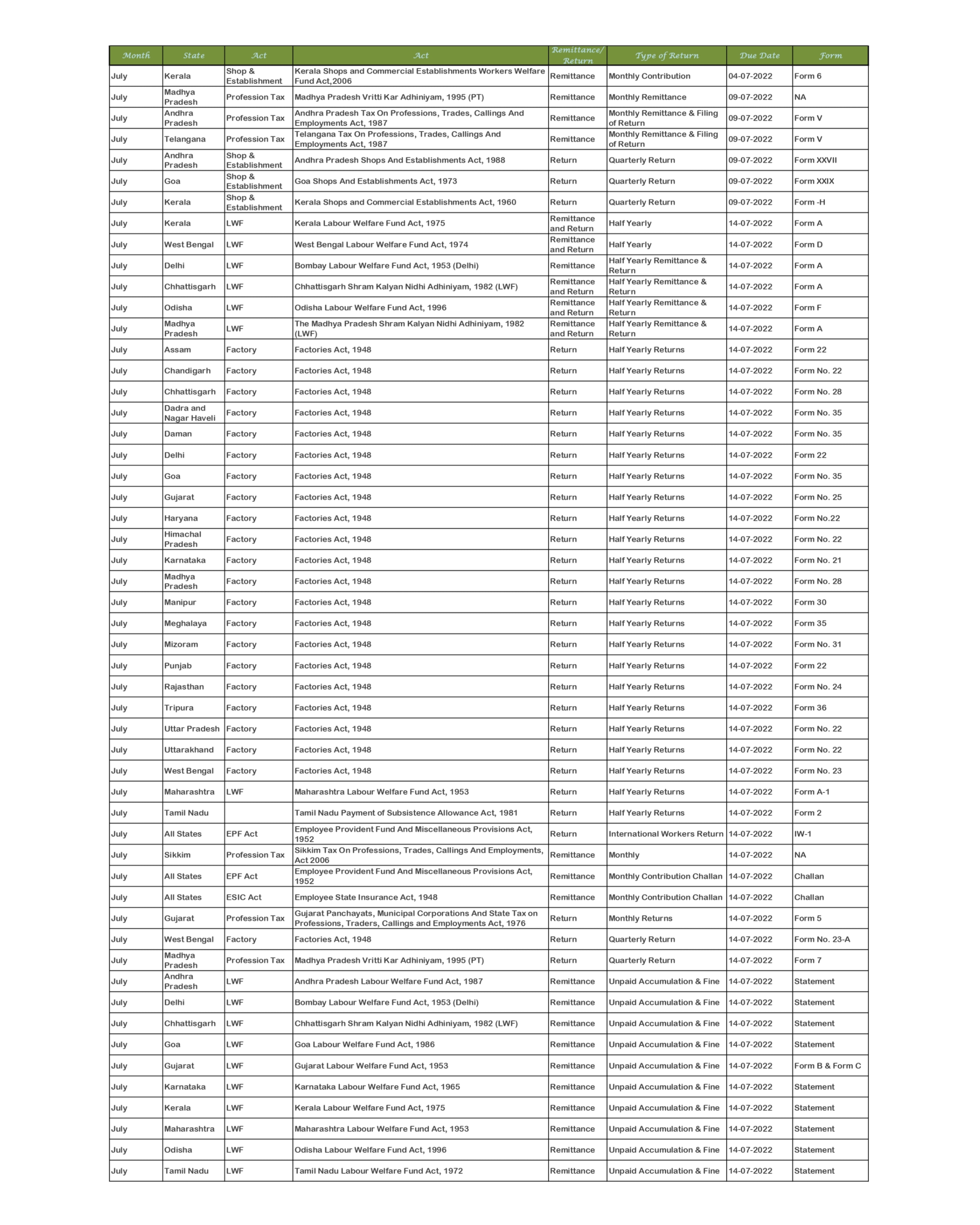

Appended below is the Pan India Compliance calendar for August 2022, employer is under obligation to contribute towards some of the above-mentioned compliances for the welfare of the employees. Each of these compliances is again governed by a set of rules and formulas. It is proven to be a deliberate attempt to violate the provisions of the law, there could be imprisonment of the employer. Please, comply with the same in time to avoid any future non-compliance so that hefty penalties and fines are not charged by the respective dept.

Appended below is the Pan India Compliance calendar for July 2022, employer is under obligation to contribute towards some of the above-mentioned compliances for the welfare of the employees. Each of these compliances is again governed by a set of rules and formulas. It is proven to be a deliberate attempt to violate the provisions of the law, there could be imprisonment of the employer. Please, comply with the same in time to avoid any future non-compliance so that hefty penalties and fines are not charged by the respective dept.

Appended below is the Pan India Compliance calendar for July 2022, employer is under obligation to contribute towards some of the above-mentioned compliances for the welfare of the employees. Each of these compliances is again governed by a set of rules and formulas. It is proven to be a deliberate attempt to violate the provisions of the law, there could be imprisonment of the employer. Please, comply with the same in time to avoid any future non-compliance so that hefty penalties and fines are not charged by the respective dept.

07th |

TDS | TDS Payment for June 2022. |

10th |

GST | Return for authorities deducting tax at source – GSTR 7 for June 2022. |

| Details of supplies effected through e-commerce operators and the amount of tax collected – GSTR 8 for June 2022. | ||

11th |

GST | Details of outward supplies of taxable goods and/or services effected – GSTR 1 for June 2022. |

13th |

GST | Quarterly Return GSTR 1 for April to June 2022 for QRMP filers, whose turnover not exceeding ₹ 5 crore |

| Return for Input Service Distributor – GSTR 6 for June 2022. | ||

15th |

P.F. | P.F. Payment for June 2022. |

| ESIC | ESIC Payment for June 2022. | |

| TDS | TCS Quarterly Statements (Other than Government Deductor) for April to June 2022. | |

18th |

GST | Quarterly Statement for composition taxable person – CMP 08 for April to June 2022. |

20th |

GST | GSTR 3B for June 2022 if aggregate turnover above ₹ 5 crore. |

| Return for Non-Resident foreign taxable persons – GSTR 5 for June 2022. | ||

22nd |

GST | GSTR 3B for June 2022 if aggregate turnover below ₹ 5 crore for Andaman & Nicobar Islands, Andhra Pradesh, Chhattisgarh, Dadra & Nagar Haveli, Gujarat, Goa, Karnataka, Kerala, Lakshadweep, Madhya Pradesh, Maharashtra, Puducherry, Tamil Nadu, Telangana. |

24th |

GST | GSTR 3B for June 2022 if turnover below ₹ 5 crore for Rest of India. |

30th |

GST | To opt out or in from QRMP for the period July to September 2022. |

31st |

TDS | TDS Quarterly Statements (Other than Government Deductor) for April to June 2022. |

| Prof. Tax | Monthly Return Tax Liability of ₹ 1,00,000/- & above for June 2022. | |

| Income Tax | Due date to Income Tax Return for non audit case for F.Y. 2021-22. | |

|

Software Solutions Available on: TDS | PAYROLL | WEB PAYROLL | WEB HRMS | XBRL | FIXED ASSET |INCOME TAX| SERVICE TAX | DIGITAL SIGNATURE | ATTENDANCE MACHINE & CCTV | DATA BACKUP SOFTWARE | PDF SIGNER |

||

|

Sensys Technologies Pvt. Ltd. HO: 904, 905 & 906, Corporate Annexe, Sonawala Road, Goregaon East, Mumbai- 400 063. |

||