Basic Principles to compute capital gains

When do capital gains arise?

Normally, only revenue receipts are taxable under the Act. Capital receipts are, as a general rule, outside the tax net. As an exception to this general rule, gains arising from the transfer of a capital asset are taxable.

So far as a salaried assessee is concerned, capital gains may normally arise when he sells a house, or agricultural land or shares or jewellery.

Two basic ingredients are for being a receipt as capital gain is:

- There should be a ‘capital asset’ owned by the assessee, and

- Such asset should have been ‘transferred‘ during the previous year.

For this purpose, the expressions ‘capital asset’ and ‘transfer have been specifically defined in the Act

What is a capital asset?

The Act gives a wide definition to the expression ‘capital asset’ to the effect that it will mean ‘property of any kind held be an assessee, whether or not connected with his business or profession.’

However it excludes the following assets from the purview of capital assets:

- Any stock-in-trade, consumable stores or raw materials held for the purpose of the assessee’s business or profession.

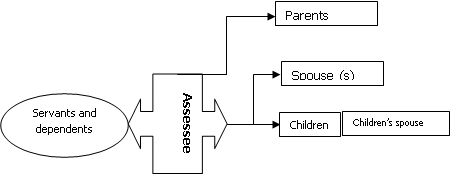

- Personal effect, i.e., movable property (including wearing apparel and furniture, but excluding jewellery, archaeological collection, drawing, painting, sculptures, or any work of an art) held for the personal use by the assessee or any member of his family dependent to him.

- A motorcar or any other vehicle held for personal use can be brought under the category of personal effect and can’t be taxed as capital gains.

- Agricultural lands situated in India other than lands situated in urban areas.

- From the assessment year 2008-09 onward personal effects exclude, in addition to jewellery, (i) archaeological collection, (ii) drawing, (iii) painting, (iv) sculptures, or (v) any work of an art. Hence, there will always be capita gain on transfer of such personal effects.

Mode of computation of capital gain:

The Act provides definite mode for computation of capital gain from transfer of capital asset. The same is enumerated as below

- Determine whether property transfer is capital assets? If yes, go to step 2.

- Determine whether your transfer is covered by the definition of – “Transaction not regarded as transfer”. If the transaction is covered under transaction not regarded as transfer then your transaction is tax free and no further computation is required. If not, go to step 3.

- Determine period of holding of asset. This is required to determine gain arising from transfer is short term or long term.

- In case of long terms capital assets apply indexation to the cost of assets before computation of capital gain.

- Compute consideration received out of transfer of asset. Consideration received means net consideration which is available after deducting from full value of the consideration the expenditure incurred wholly and exclusively in connection with the transfer as incurred by transferor. This may include the below mentioned expenses:

- Cost of stamp paper purchase

- Stamp duty and registration fees

- Brokerage and commission paid to the negotiators / agents.

- Any legal expenses incurred by the transferor to effect transfer of title.

- Compute cost of acquisition and cost of improvement. Apply ratio of cost inflation index in suitable cases.

- Adjust suitably cost with any advance received in past and forfeited as sale was not finally metalized.

- Compute gain (short term / long term as the case may be)

- Adjust the above gain with the amount of exemption available under section 54 of the act.

Treatment of capital losses:

The situation may arise where the consideration for transfer is less than the cost of acquisition plus expenses on transfer. This will result you in loss.

Losses from transfer of short term capital asset can be set off against any capital gain (whether long term or short term).

Losses arising from transfer of long term capital asset will be allowed to be set off only against long term capital asset.

Both short term and long term capital loss shall be allowed to carry forward for 8 years.

After carried forward short term capital loss may be set off against any income under the head capital gain – whether it is short term capital gain or long term capital gain.

After carried forward long term capital loss can be set off against long term capital gain.