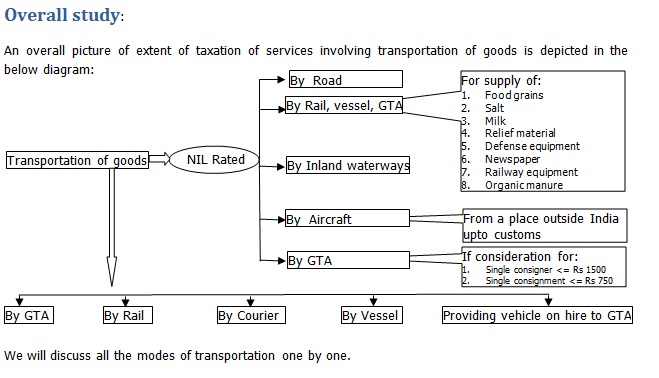

Manner of taxation of transportation of goods under GST

Timely and smooth transportation of goods play an important role in supply chain distribution system of any economy. Effective cost of transportation is important for pricing of a product not only from the point of view of consumer but for the economy as a whole. Effective cost of transportation has direct and immediate impact on the price of a product as well as GDP of the country. Here, we will discuss the manner and rate of taxation of transportation of goods within India.

Transportation by road:

Transportation of goods by road may be done through GTA, on public vehicle, or via courier services. Transportation of goods by road within India is NIL rated in case goods transported falls under any one of the following category:

- Relief materials meant for victims of natural or man-made disasters, calamities, accidents or mishap;

- Defence or military equipments;

- Newspaper or magazines registered with the Registrar of Newspapers;

- Railway equipments or materials except when transported through GTA;

- Agricultural produce;

- Milk, salt and food grain including flours, pulses and rice; and

- Organic manure.

Transportation of goods through GTA is NIL rated in the following cases:

- goods, where consideration charged for the transportation of goods on a consignment transported in a single carriage does not exceed Rs 1500/-;

- goods, where consideration charged for transportation of all such goods for a single consignee does not exceed Rs 750/-;

The above rule may further be examined in the below table:

| Carriage | Consignment notes | Consideration charges | Effect |

| Single | Single | <= Rs 1500 | No GST |

| Single | Single | > Rs 1500 | GST |

| Single | Multiple | <= Rs 750 per consignee | No GST for those consignment where consideration charges is less than Rs 750 |

| Single | Multiple but all are in the name of same person | <= Rs 750 per consignee | GST |

| In all other permutation GST will be payable. | |||

Rate of GST

| Mode of transportation | Rate of GST |

| Courier | 18% with ITC |

| Rail – when taken part of the space in a container | 5% with ITC |

| Rail – when whole container taken on hire | 12% with ITC |

| GTA | 5% with no ITC |