The government of Madhya Pradesh has issued a circular to all jurisdictional officers in Madhya Pradesh under The Inter-State Migrant Workmen (Regulation of Employment and Conditions of Service) Act, 1979. As per the circular, the labor department has directed all jurisdictional officers to run a special campaign from 1st July 2021 to 31st July 2021 for registration of major employers and license to the contractor and make all the employers or institutions and labor organizations of their jurisdiction aware of instructions as mentioned in the circular.

Synopsis

- As per section 18 employer without permission, no employee will be deployed from one state to another.

- As per section 13, all inter-state migrant workers’ wages will be paid as per the minimum wages act.

- Employer will have to bear the cost of traveling to & fro of the respective employee.

- All Employer are advised to issue One passbook which will include the details of the employee/Employer /Employee Photo & all emergency contact number/KYC Details.

- All Wages will be transferred to the respective bank account.

- All Wages will be transferred to the respective bank account.

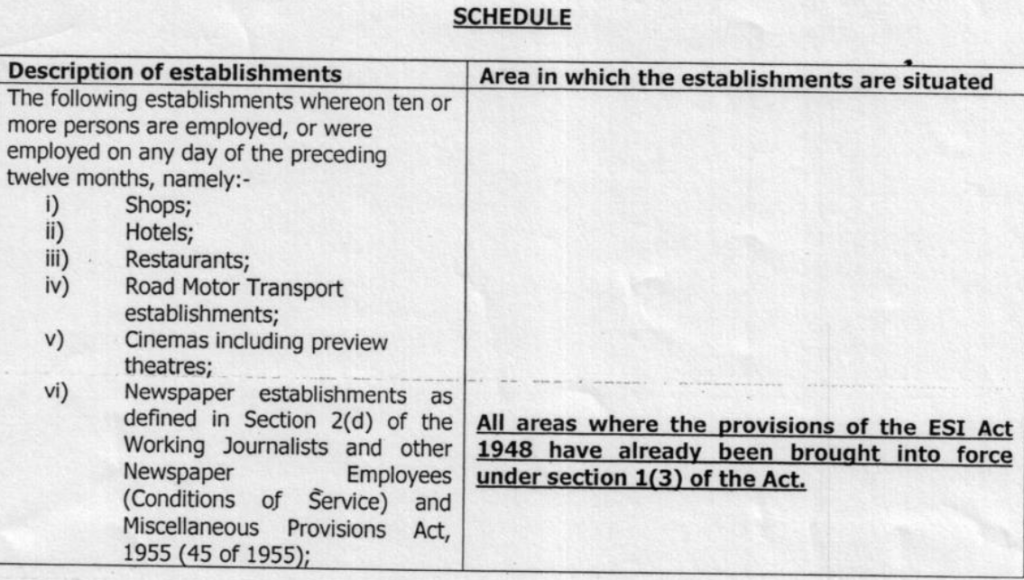

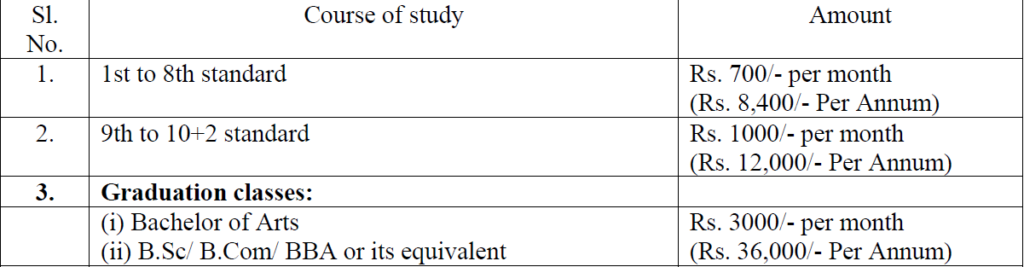

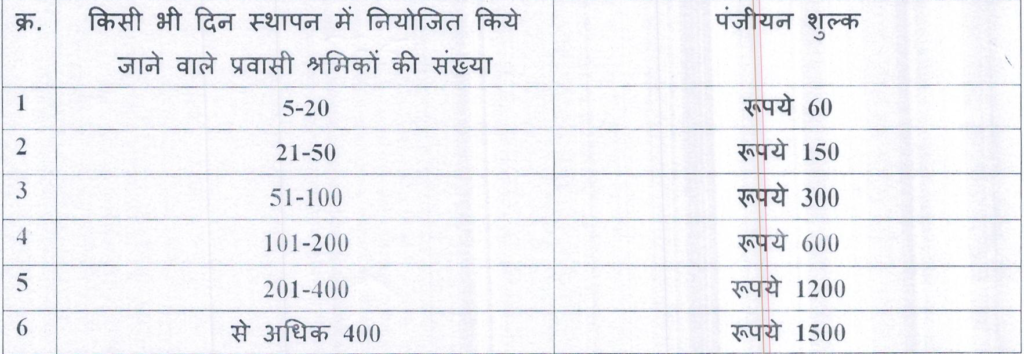

All Employer wherein on any day or having more than 5 migrant workers will have to register & pay a nominal fee for Registration per the chart given below

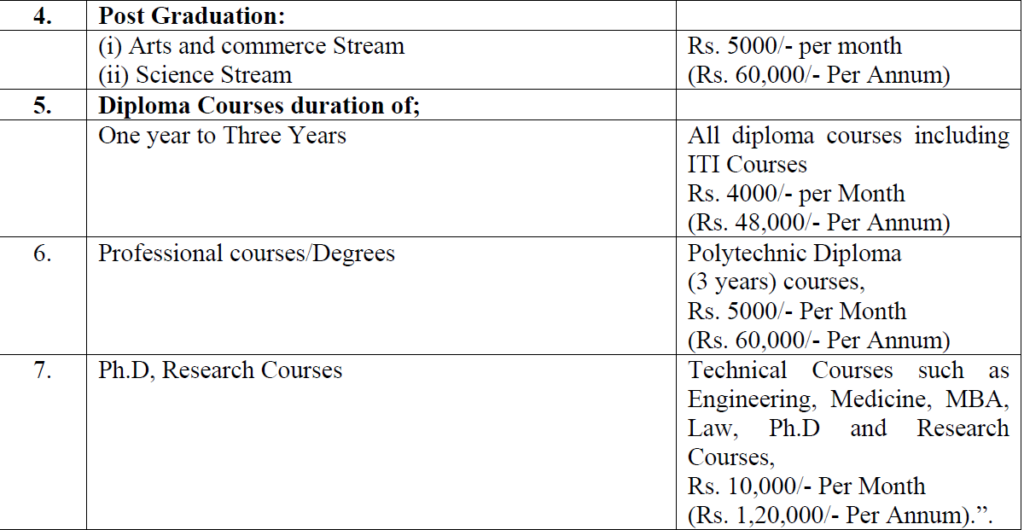

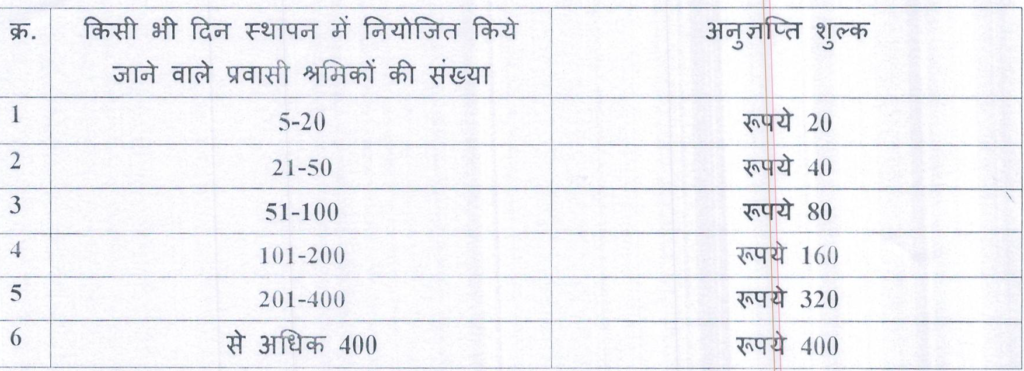

Also the License fees as per the chart

CLICK ON THE BELOW LINK FOR MORE DETAILED INFORMATION:

Courtesy: PRAKASH CONSULTANCY SERVICE