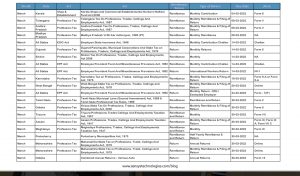

The Governor of Punjab vides notification dated 3 March 2022 formulates a scheme for the shops and establishments in the state by which exemption from Section 30 (conditions of employment of women) of the Punjab Shops and Commercial Establishment Act 1958 is granted. The exemption will be given on a case-to-case basis on receipt of applications from the establishments on the following terms and conditions:-

1. The Establishment must be registered/ renewed under the Punjab Shops and Commercial.

2. Establishment Act, 1958.

3. The total no. of hours of work of an employee in the establishment shall not exceed nine hours on any one day and 48 hours in a week.

4. The spread over-inclusive of interval for rest in the establishment shall not exceed twelve hours on any one day.

5. The total no. of hours of overtime work shall not exceed fifty in any one quarter and the person employed for overtime shall be paid remuneration at double the rate of normal wages payable to him calculated by the hour.

6. The Management will ensure –

1. Protection of women from Sexual Harassment at the workplace.

2. Adequate Security and proper Transport facility to the women workers including women employees of contractors during the evening/night shifts. Ln case the management is not providing transport facility or security through employees directly recruited by him and proposes to provide through service providers then the Management shall execute the Security and Transport Facility Contract with an appropriately licensed/registered Security Agency.

3. Women employees will board the vehicle in the presence of security guards on duty.

4. Security ln-charge/Management have maintained the Boarding Register or computerized record consisting of the Date, Name of the Model & Manufacturer of the Vehicle, Vehicle Registration No., Name of the Driver, Address of the Driver, Phone/ Contact No. Of the Driver and Time of Pickup of women employees from the residence to the establishment and vice versa.

5. Attendance Register of the security guard is maintained by the security in charge/management.

6. Transport vehicle in-charge /security in-charge/management maintains a movement register.

7. No employee of any establishment shall knowingly employ a woman and no woman shall engage in employment in any establishment during six weeks following the day of her confinement or miscarriage.

8. Vehicle does not have black or tinted glasses and also ensure that there are no curtains in the vehicle and occupants of vehicle are clearly visible from all sides.

9. Emergency call nos. Are prominently displayed inside

the vehicle.

10. Driver will not pick up any women employee first for workplace and will not drop her last at home/ her accommodation.

11. Driver will not leave the dropping point before the women employee enters into her accommodation.

12. There is an annual self defense workshop/training for

women employees.

13. In the night shift, minimum of five women employees

shall be employed.

7. The manager of the establishment will be required to abide by the provisions of Sexual Harassment of Women at Work Place (Prevention, prohibition and Redressal) Act. 2013.

Punjab grants exemption to SE from condition of employment of women – DOWNLOAD

SOURCES BY: PRAKASH CONSULTANCY SERVICE