The following conditions shall be satisfied for levy of CGST/SGST:

- There must be a person.

- There must be a taxable person.

- There must be some goods and/or services

- Such goods must be specified in schedule …. of this act.

- There must be an intra state supply (supply within state) of such goods and/or services.

- The tax shall be paid at the time of supply.

If any of the above ingredient is missing the tax is not payable.

Taxable person

Taxable person means a person who carries on any business at any place in India / state of ….. and who is registered or required to be registered under Schedule III of this act.

Goods and / or services

“Goods” means every kind of movable property other than actionable claim and money but includes securities, growing crop, grass and things attached to or forming part of the land which are agreed to be severed before supply or under the contract of supply.

Movable property shall not include any intangible property.

“Services” means anything other than goods. Services includes intangible property and actionable claim but does not include money.

| Description of supply | Goods | Services |

| Movable property, i.e., things which can be moved from one place to another without dismantling. | ✔ | x |

| Growing crops | ✔ | x |

| Things attached to land and agreed to be severed before supply | ✔ | x |

| Securities | ✔ | x |

| Actionable claim | x | ✔ |

| Things attached to land and supply as such, i.e., immovable property | x | ✔ |

| Intangible property | x | ✔ |

| Money | x | x |

Goods and/or services must be specified in schedule

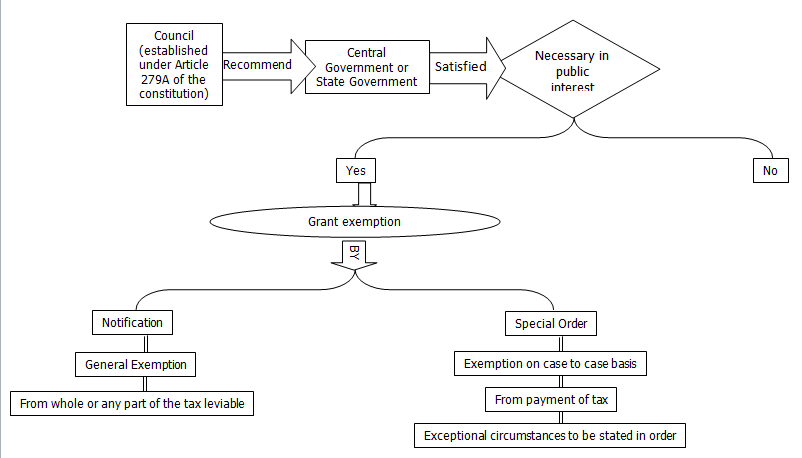

The goods and / or services must be specified in schedule. The tax shall be levied at the rates specified in that schedule. However Central government or state government have power to give exemption from payment of tax. The process of giving exemption is detailed in following diagram:

Supply

The liability to pay GST arises when there is a supply of goods and/or services. Under GST regime supply is taxable activity. Section 3 of the act had widened the scope of the terms supply from its natural meaning. From the plain reading of section following shall be included within supply:

- Sale made or agreed to be made for a consideration in the course or furtherance of business.

- Transfer made or agreed to be made for a consideration in the course or furtherance of business.

- Barter / exchange made or agreed to be made for a consideration in the course or furtherance of business.

- License made or agreed to be made for a consideration in the course or furtherance of business.

- Rental made or agreed to be made for a consideration in the course or furtherance of business.

- Lease made or agreed to be made for a consideration in the course or furtherance of business.

- Disposal made or agreed to be made for a consideration in the course or furtherance of business.

- Import of service.

- Permanent transfer / disposal of business assets made or agreed to be made without a consideration.

- Temporary application of business assets to a private or non business use made or agreed to be made without a consideration.

- Service put to a private or non-business use made or agreed to be made without a consideration.

- Assets retained after deregistration.

- Supply by a taxable person to another taxable or non taxable person in the course or furtherance of business made or agreed to be made without a consideration excluding supply to job worker.

After having ascertained that there is a supply, next step is to identify whether it is supply of goods or supply of service. The detailed guideline for the same is given in Schedule II of the act and will be deal in our next blog.