Steps for e-Filing of Income Tax Returns (ITR)

The process electronically filing Income Tax Returns (ITR) through the internet is known as e-Filing. It is mandatory for companies and firms requiring statutory audit u/s 44AB to submit the Income Tax Returns electronically for AY 2007-08 onwards. e-Filing is possible with or without Digital Signature.

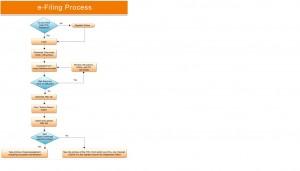

e-Filing Process

(1) Select the appropriate type of Income Tax Return(ITR) form which you wish to proceed with e-Filing in the Sensys Income Tax Return Software also known as Sensys eForm Expert.

(2) Fill the selected ITR Form and generate the XML file.

(3) Go to Income Tax site http://www.incometaxindiaefiling.gov.in and then register yourself by using your PAN no. Create your User Id and Password at this stage.

(4) Under the Download menu on the left panel, select the appropriate ITR Form and select the option ‘Submit Return’ for FY 2011-12, AY 2012-13.

(5) Next, select the form name whichever is applicable. Click ‘Browse’ to select the XML file and click the ‘Upload Button’.

(6) On successful upload, the acknowledgement details would be displayed. Click the ‘Print’ button to take the print-out of the acknowledgment form.

(7) In case the return is digitally signed, on generation of “acknowledgement”, the return filing process gets completed. You may take a printout of the acknowledgement for your record.

(8) In case the return is not digitally signed, on successful uploading of e-Return, the ITR-V form will be generated which needs to be printed by the tax payers. This is an acknowledgement cum verification form. The tax-payer has to fill up the verification part and verify the same. A duly verified ITR-V form should be submitted with the Income Tax Office within 120 days of filing electronically.

The e-Filing process is explained with the help of a flow chart. Click the images below to enlarge it.