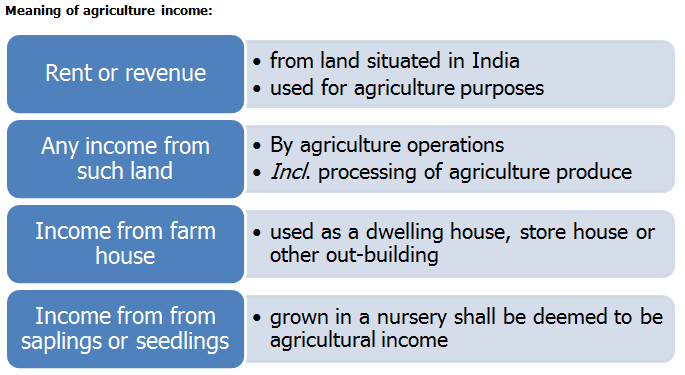

Meaning and Significance of Agriculture Income

Significance of having agriculture income:

Section 10(1) exempts agricultural income from tax. The reason of exemption of agricultural income from Central taxation into is that the constitution gives exclusive power to make laws with respect to taxes on agricultural income to the State Legislature. However in some cases agricultural income is taken consideration to determine tax on non- agricultural income.

Frequently asked question:

Q1. Whether ownership of land is prime conditions for claiming agriculture income?

Sol: , it is not necessary that the recipient of rent or revenue should be the owner of the agricultural land. If rent is received by an original tenant from sub-tenant under sub-lease or rent is received by a mortgagee in possession of agricultural land, the receipt may be “agricultural income”, if the other two conditions are satisfied that is

- Land is one which is situated in India

- Land is used for agriculture purposes

Q2. Whether agriculture income derived from foreign lands are eligible for exemption from taxation:

Sol: – Rent or revenue would be ‘agricultural income” if land is situated in India. This condition is to be fulfilled not only in sub-clause (a) but also I sub-clauses (B) and (C) of section 2(1A). Income from foreign agricultural land is outside the scope of exemption given by section 10(1) and consequently it may be taxable in India depending upon residential status of the recipient.

Q3 What are agriculture purposes to constitute income eligible for exemption?

Sol: To constitute an agriculture activity one must undertake agriculture activity. This means, one must have undertaken basic activity and subsequent activities to generating agriculture income.

| Basic operations | Subsequent operations |

| The basic 0perations would involve expenditure of human skill and labour upon the land itself and not merely on the growths from the land. | There are certain subsequent operations which are performed after the produce sprouts from the land. |

| For example: | |

| tilling of land, sowing of the seeds, planting and similar operations | weeding , digging the soil around the growth, removal of undesirable undergrowths and all operations which foster the growth and preserve the same not only from insects and pests but also from depreciation from outside, tending, pruning, cutting, harvesting and rendering the produce fit for the market. |

Mere performance of subsequent operations on the products of the land (where such products have not been raised on the land by the performance of the basic operations described above) would not be enough to characterize them as agricultural operation. Where, however, the subsequent operations are performed in conjunction with and in a continuation of the basic operations, the subsequent operations would also constitute part of the integrated activity of agriculture.

Q4: Whether growing of food grains and eatables would constitute agriculture income?

No, it includes all products, from the performance of basic as well as subsequent operations on land. These products, for instance, may be grains or vegetable or fruits including plantation and groves, grass or pasture for consumption of beast or articles of luxury such as betel, coffee, tea , spices, tobacco, etc , or commercial crops like cotton, flax ,jute, hemp, indigo, etc. All these are products raised from the land.

Q5: Give some instances of agriculture income and non agriculture income.

| Agriculture income | Non agriculture income |

| 1. Sale of replanted trees

2. Fees for grazing 3. Rent for agricultural land received from sub-tenants by mortgagee in possession. 4. Compensation received from an insurance company for damage. 5. Growing flowers and creepers. 6. Share of profit of a partner from a firm engaged in agricultural operation. 7. Interest on capital received by a partner from the firm engaged in agricultural operation. 8. The income derived from the sale of seeds is an agricultural income 9. Income derived by growing special quality of grass required for creating golf course is agricultural income. |

1. Annual annuity received by a person in consideration of transfer of agricultural land

2. Interest on arrears of rent payable in respect of agricultural land. 3. Income from sale of forest trees, fruits and flowers growing on land naturally. 4. Income of salt produced by flooding the land with sea water. 5. Profit accruing from the purchase of a standing crop and resale of it after harvest. 6. Remuneration received by a managing agent at a fixed percentage of net profit from company having agricultural income. 7. Interest received by a money-lender in the form of agricultural produce. 8. Dividend paid by a company out of its agricultural income. 9. Income from fisheries. 10. Royalty income of mines. 11. Income from butter and cheese-making. 12. Income from poultry farming. 13. Income from supply of water. 14. Income from sale of tender forms by the assessee. 15. Income from toddy tapping 16. |