Tax collection on Cash payments

Section 206(1D)

Every person, being a seller, who receives any amount in cash as consideration for sale of bullion or jewellery 87[or any other goods (other than bullion or jewellery) or providing any service], shall, at the time of receipt of such amount in cash, collect from the buyer, a sum equal to one per cent of sale consideration as income-tax, if such consideration,—

(i) for bullion, exceeds two hundred thousand rupees; or

(ii) for jewellery, exceeds five hundred thousand rupees; 88[or]

88[(iii) for any goods, other than those referred to in clauses (i) and (ii), or any service, exceeds two hundred thousand rupees:

Provided that no tax shall be collected at source under this sub-section on any amount on which tax has been deducted by the payer under Chapter XVII-B.]

88[(1E) Nothing contained in sub-section (1D) in relation to sale of any goods (other than bullion or jewellery) or providing any service shall apply to such class of buyers who fulfill such conditions, as may be prescribed.

Why this section:

Indian economy was facing with some serious problems like:-

- Large flow of unaccounted cash in trading system resulting in loss of revenue and growth of economy.

- Large quantum of cash transactions in the sale of goods and services resulting in such transaction remain unnoticed to taxman.

Hence, there was a great necessary to bring high value transaction into tax net and promote more transaction via baking channel.

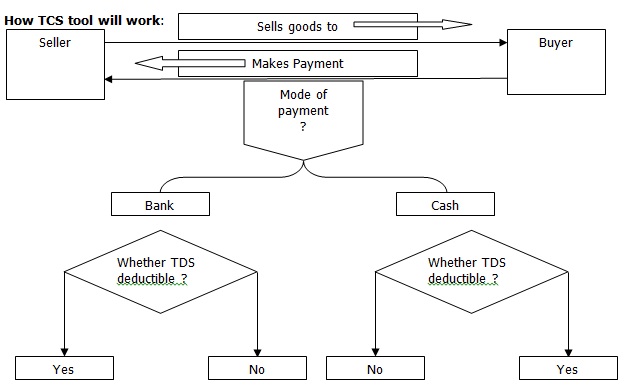

In essence the objective to introduce TCS on cash payment is to trace high value transactions.

Now, henceforth high value transactions can not remain unnoticed. Either these can be traceable via banking channels or can be traceable in the returns of buyers and sellers; as either buyer might have deducted TDS on such payments while making payment or buyer must have paid TCS to seller and must have claimed in his returns.

Practicable problems in application of TCS:

| Issue | Solutions | ||||||||||||||||||||||||

| Whether TCS shall be collected on each bill or aggregate value of bills made during a particular year? | While considering TCS, case of each transaction needs to be consider separately:For example:Mr X sold goods and received payment in the following manner:

Now for applicability of TCS bill no 1 & bill no 2 are two different transactions and as in both cases cash involvement is not more than two lacks and hence TCS need not to be collected. |

||||||||||||||||||||||||

| Whether TCS needs to be collected by an individual seller | Yes, if such individual seller is liable to get his accounts audited under income tax act. | ||||||||||||||||||||||||

| What if only part payment is made in cash? | TCS needs to be collected in part cash payment only if such part exceeds two lacs rupees. | ||||||||||||||||||||||||

| Whether TCS will be collected on total value of transaction or only such part which is paid in cash? | TCS will be collected only on such part payment which is made in cash. |