THE EMPLOYEES’ PROVIDENT FUNDS AND MISCELLANEOUS PROVISIONS ACT, 1952

Section 1. Short title, extent and application.-

(1) This Act may be called the Employees‟ Provident Funds and Miscellaneous Provisions Act, 1952.

(2) It extends to the whole of India except the State of Jammu and Kashmir.

(3) Subject to the provisions contained in section 16, it applies –

(a) To every establishment which is a factory engaged in any industry specified in Schedule I and in which twenty or more persons are employed and

(b) To any other establishment employing twenty or more persons or class of such establishments which the Central Government may, by notification in the Official Gazette, specify, in this behalf:

Provided that the Central Government may, after giving not less than two months‟ notice of its intention so to do, by notification in the Official Gazette, apply the provisions of this Act to any establishment employing such number of persons less than twenty as may be specified in the notification.

(4) Notwithstanding anything contained in sub-section 3 of this section or-sub-section 1 of section16, where it appears to the Central Provident Fund Commissioner, whether on an application made to him in this behalf or otherwise, that the employer and the majority of employees in relation to any establishment have agreed that the provisions of this Act should be made applicable to the establishment, he may, by notification in the Official Gazette, apply the provisions of this Act to that establishment on and from the date of such agreement or from any subsequent date specified in such agreement.

(5) An establishment to which this Act applies shall continue to be governed by this Act notwithstanding that the number of persons employed therein at any time falls below twenty.

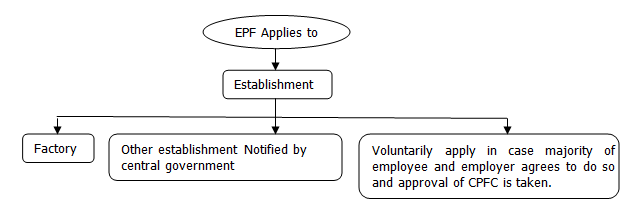

From the above it can be said that Employees Provident fund is applicable to three types of establishment:

Situation 1:

Where the company is in the process of winding up an official liquidator has been appointed:

When the company is in the process of winding up and official liquidator has been appointed, the provident fund contribution need not to be deposited for a few employees who have been retained by the liquidator.

The court in the case of Regional Provident Fund Commissioners v Rohatas Industries Limited, observed that it is not in dispute that:

- Different units of the Company have been out of operation.

- These units were closed since a long time.

- They were not running at all at present.

The establishment was in the process of winding up and not engaged in any industrial activity specified in Schedule 1 nor specially notified under section 1(3)(b) of the act. Hence, in such circumstances establishment is not covered under EPF and hence contributions need not to be deposited.

Situation 2:

Will a factory or establishment be covered under the EPF Act when the construction activity has started and there are more than 20 workers?

The above analogy may be applied in the present case also. Since the specified activities are in the process of establishing the factory which is yet to come into existence and start operations. It does not meet the specification stipulated in section 1(3)(a). Hence, if the establishment is not notified under section 1(3)(b) the statutory requirement for applicability of the act provision is not fulfilled. Hence, no liability arises.

Conclusion

Hence, from the above discussion it can be safely concluded that a factory needs to deposited contribution only when in is working under normal operations. Contribution for construction period and post liquidation needs not to be deposited.