|

|

Due dates for the Month of August 2018

|

|

7th

|

Income Tax – TDS Payment for July |

|

10th

|

GST – Details of outward supplies of taxable goods and/or services effected – GST1 for July – Return for authorities deducting tax at source – GSTR 7 for July – Details of supplies effected through e-commerce operator and the amount of tax collected – GSTR 8 for July |

|

13th

|

GST – Return for Input Service Distributor – GSTR 6 for July |

|

15th

|

Providend Fund – PF Payment for July ESIC – ESIC Payment for July |

|

15th

|

GST – Details of inward supplies of taxable goods and/or services effected claiming input tax credit – GSTR 2 for July |

|

20th

|

GST – Monthly return on the basis of finalisation of details of outward supplies and inward supplies along with the payment of amount of tax – GSTR 3 for July – Return for Non-Resident foreign taxable person – GSTR 5 for July |

|

28th

|

GST – Details of Inward Supplies to be furnished by a person having UIN and claiming refund – GSR 11 for July. |

|

31st

|

Profession Tax – Monthly Return (covering salary paid for the preceding month) (Tax Rs. 50,000 or more) |

|

31st

|

AIR – Annual Information Return for Previous Financial Year |

|

Software Solutions Available on:

TDS | PAYROLL | WEB PAYROLL | WEB HRMS | XBRL | FIXED ASSET |INCOME TAX| SERVICE TAX | DIGITAL SIGNATURE | ATTENDANCE MACHINE & CCTV | DATA BACKUP SOFTWARE | PDF SIGNER |

|

|

Sensys Technologies Pvt. Ltd.

HO: 524, Master Mind1, Royal Palms, Goregaon East, Mumbai – 400 065. Tel.: 022-66278600 | Call: 09769468105 / 09867307971 Email: sales@sensysindia.com | Website: http://www.sensysindia.com Branches: Delhi & NCR | Pune | Bangalore | Hyderabad | Ahmedabad | Chennai | Kolkata |

|

|

Visit our BLOG for latest news and updates related to XBRL, Income Tax, HR & Payroll, PF / ESIC / TDS / PT etc.. Click here to visit Sensys BLOG

|

|

Key changes in ITRS’ form disclosure requirement

With invent of GST tax regime and other regulatory requirements various changes have been made in ITR forms. It is recommended that these changes should be properly understood before start filing ITR forms. Any wrong and incomplete information would have adverse impact on the assessee. Hence, a list of such changes is enumerated below:

For individual filing ITR 1:

For Assessment Year 2018-19, a one page simplified ITR 1 (Sahaj) has been notified. In ITR 1 of A.Y.2018-19, certain details relating to salary and income from house property have to be mandatorily filled in the form itself.

- In case of salary, the details relating to salary (excluding all allowances, perquisites and profits in lieu of salary), allowances not exempt, value of perquisites, profits in lieu of salary and deductions under section 16 have to be filled up to arrive at the income chargeable under the head “Salaries”.

- In case of income from house property, the details relating to gross rent received/receivable and taxes paid to local authorities have to be filled up to arrive at the annual value.

- Hence, deduction @ 30% of annual value and interest payable on borrowed capital has to be filled up to arrive at the income chargeable under the head “Income from house property”.

Only an Individual, who is an ordinarily resident in India, can file income-tax return in Form ITR-1.

For individuals / HUFs filing ITR 2:

Income from Business or Profession is no more reportable in this return and further the assessees’ opting for presumptive tax regime also cannot use this return.

Last year (i.e. A.Y.2017-18), individuals and HUFs in receipt of salary, bonus, commission or remuneration from a firm in which they are partners, or in receipt of interest on capital from the firm, could also file ITR 2. This year, such persons have to file ITR 3.

For individuals / HUFs filing ITR 3:

Income from Business or Profession (either from presumptive or normal) earned by an Individual or HUF can be reported in this return. For presumptive income though there is a separate return prescribed but the Assessee has the option to use this form also.

For individuals / HUFs filing ITR 4:

ITR 4 (SUGAM) can be used by eligible assessees having presumptive income from business or profession under section 44AD, 44ADA or 44AE, under the head “Profits and gains of business or profession” have to file return in ITR 4. In addition, they may have salary income, income from one house property and income from other sources. (Except winning from lotteries etc).

Additional information in ITR 4:

- Information relating to the GST Number and the Turnover/Gross Receipt as per GST return

- The details provided are verified correspondingly with GST Returns, if applicable and also with Form 26AS.

- In addition to sundry creditors, ITR 4 seeks details of partners/ members own capital, secured and unsecured loans, advances and other liabilities. The total capital and liabilities would be the sum of the figures of the above assets.

- In addition to the three items of assets which are required to be disclosed in ITR 4 for A.Y.2017-18, ITR 4 for A.Y.2018-19 seeks details of balance with banks, loans and advances and other assets. The total assets would be the sum of the figures of the above assets.

Thus, before start filing income tax return for assessment year 2018-19 (relevant previous year 2017-18) once should collect correct and true information about the above additions and cross tallied the figures with GST return to avoid future problems.

Applicability of ITR forms for AY 2018-19

With the 31st July, 2018 is approaching nearby you are rushing behind your consultant for completing self-assessment process and filling your ITR. As you are aware that forms you submit to the department plays an important role in the assessment procedure and correct filing of forms saves you from needless penalties action. Under section 139(4) a return filed in wrong ITR can be treated as defective and you would returned to the consequences as if you have not filed the return. Hence, here we are trying to explain applicability of ITR in very simple manner.

Applicability of income tax return (ITRs’) forms based on nature of income:

| ITR 1 | |||||

| NATURE OF INCOME | (only | ITR 2 | ITR-3 | ITR-4 | |

| Resident | |||||

| IND) | |||||

| Income from salary/pension (for ordinarily resident person) | YES | YES | YES | YES | |

| Income from salary/pension (for RNOR & NR person) | – | YES | YES | YES | |

| Income or loss from one house property (excluding brought forward & carried forward losses) | YES | YES | YES | YES | |

| Income or loss from more than one house Property | – | YES | YES | – | |

| Agricultural income exceeding Rs. 5,000 | – | YES | YES | – | |

| Total income exceeding Rs. 50 lakhs | – | YES | YES | YES | |

| Income from other sources (other than winnings from lottery and race horses or losses under this head) | YES | YES | YES | YES | |

| Income from other sources (including winnings from lottery and race horses or losses under this head) | – | YES | YES | – | |

| Capital gains/loss on sale of Capital assets | – | YES | YES | – | |

| Interest, salary, share of profit, etc. received by a partner from a partnership firm. | – | – | YES | – | |

| Income from business or profession (Non Speculative) | – | – | YES | – | |

| Income from presumptive business | – | – | YES | YES | |

| Income from Speculative Business and other special incomes | – | – | YES | – | |

| Income from an agency business or income in the nature of commission or brokerage | – | – | YES | – | |

| Income from foreign sources/assets/any account outside India | – | YES | YES | ||

| Claim of relief of tax under sections 90, 90A or 91 | – | YES | YES | ||

| Dividend income exceeding Rs. 10 lakhs taxable under Section 115BBDA | – | YES | YES | ||

| Voluntary offer of income under Sections 68, 69, 69A, etc. [taxable at 60% u/s 115BBE) | – | YES | YES | ||

| Income to be apportioned under Section 5A (Relating to clubbing of Income for Portuguese Citizens) | – | YES | YES | YES | |

| Adjustments of Brought Forward Losses of earlier years | – | YES | YES |

Change of Email ID and mobile nos in GSTN

Significance of E-mail ID and phone number in GSTN:

E-mail ID and mobile nos. are media to communicate with GSTN instantly for different purposes. These are required for the following purposes:

- At the time of registration to generate TRN and GST user ID and first time login password

- At the time of filling GST return

- At the time submitting query, complaints etc

- At the time of cancellation

- To receive orders etc

Thus, e-mail ID and mobile number is required at every time while doing work with GSTN.

Change of email and mobile number of the authorized signatory by taxpayers with assistance from the jurisdictional tax officer:

Complaints are being received from taxpayers that the intermediaries who were authorized by them to apply for registration on their behalf had used their own email and mobile number during the process. They are now not sharing the user credentials with the taxpayer on whose behalf they had done the registration in the first place and the taxpayer is at their mercy.

With a view to address this difficulty of the taxpayer, a functionality to update email and mobile number of the authorized signatory is available in the GST System.

The email and mobile number can be updated by the concerned Jurisdictional tax authority of the taxpayer as per the following procedure:

- Taxpayer is required to approach the concerned jurisdictional Tax Officer to get the password for the GSTIN allotted to the business.

- Taxpayer would be required to provide valid documents to the tax officer as proof of his/her identity and to validate the business details related to his GSTIN.

- Tax officer will check if the said person is added as a Stakeholder or Authorized Signatory for that GSTIN in the system.

- Tax officer will upload necessary proof on the GST Portal in support to authenticate the activity.

- Tax officer will enter the new email address and mobile phone number provided by the Taxpayer.

- After upload of document, Tax officer will reset the password for the GSTIN in the system.

- Username and Temporary password reset will be communicated to the email address as entered by the Tax Officer.

- Taxpayer need to login on GST Portal https://www.gst.gov.in/ using the First time login link.

- After first time login with the Username and Temporary password that was emailed to him, system would prompt the taxpayer to change username and password. The said username and password can now be used by the taxpayer.

Non applicability of Section 44AD in certain cases

Substituted by the Finance Act, 2016, w.e.f. 1-4-2017 [Subsection 4 of section

44AD]:

Where an eligible assessee declares profit for any previous year in accordance with the provisions of this section and he declares profit for any of the five assessment years relevant to the previous year succeeding such previous year not in accordance with the provisions of sub-section (1), he shall not be eligible to claim the benefit of the provisions of this section for five assessment years subsequent to the assessment year relevant to the previous year in which the profit has not been declared in accordance with the provisions of sub-section (1).

Analysis of the above provision:

| Provision | Analysis | Example |

| Previous year: Eligible assessee declared profit under presumptive scheme. | That means in the previous year assess ascertain his profit @ 6% / 8% of gross sales as the case may be. | Take current previous year as example: Previous year : 2018-19 |

| For next five assessment years: in any such assessment year he declares profits not in accordance with this provision. | After previous year, in any one out of next five years he declares his profit as per normal calculation, i.e., as per his profit and loss account. | 1st AY after PY 2018-19. is 2020-21

2nd AY after PY 2018-19. is 2021-22 3rd AY after PY 2018-19. is 2022-23 4th AY after PY 2018-19. is 2023-24 5th AY after PY 2018-19. is 2024-25

In any one the above assessment years he declares profit as per his profit and loss account. |

| Result: He shall not be eligible to claim the benefit of the provisions of this section for five subsequent assessment years | Thus, the assessee under consideration shall not be eligible to claim benefit of above provision for next five assessment years from the assessment year in which he has not claim profit as per section 44AD. | Let suppose he has not claim profit for AY 2023-24 as per section 44AD. Now from AY 2024-25 to 2028-29 he is not eligible for section 44AD benefit. He shall have to claim profit as per normal computation. |

Explanatory notes to the above provision:

It has been further provided that where an eligible assessee declares profit for any previous year in accordance with the provisions of this section and he declares profit for any of the five consecutive assessment years relevant to the previous year succeeding such previous year not in accordance with the provisions of this section, he shall not be eligible to claim the benefit of the provisions of this section for five assessment years subsequent to the assessment year relevant to the previous year in which the profit has not been declared in accordance with the provisions of this section.

Case study:

An eligible assessee claims to be taxed on presumptive basis under section 44AD for Assessment Year 2017-18 and offers income of Rs. 8 lakh on the turnover of Rs. 1 crore. For Assessment Year 2018-19 and Assessment Year 2019-20 also he offers income in accordance with the provisions of section 44AD. However, for Assessment Year 2020-21, he offers income of Rs.4 lakh on turnover of Rs. 1 crore.

In this case since he has not offered income in accordance with the provisions of section 44AD for five consecutive assessment years, after Assessment Year 2017-18, he will not be eligible to claim the benefit of section 44AD for next five assessment years i.e. from Assessment Year 2021-22 to 2025-26.

Conclusion:

Thus, now as per above provision an assessee is bound to claim 44AD benefit for at-least 5 consecutive assessment year. If he does not do so in any one assessment year is not eligible for benefit for next five years.

Types of discounts and its role in GST

Meaning of discount under GST:

Discounts means a reduction made from the gross amount or value of something: such as, a reduction made from a regular or list price offering customers a ten percent discount or buy tickets at a discount. A proportionate deduction from a debt account usually made for cash or prompt payment or a deduction made for interest in advancing money upon or purchasing a bill or note not due

There are many types of Discount: like cash discount, quality discount, quantity discount and performance discount.

If one registered dealer purchase or sale goods from another register dealer and he is giving discount on value of goods and / or services supplied then there may be different implications of such discounts based on manner of calculating it.

Role of discount while calculating GST:

Value of taxable supply – Section 15 of CGST Act: Sub – section (3) The value of the supply shall not include any discount which is given––

- before or at the time of the supply if such discount has been duly recorded in the invoice issued in respect of such supply; and

- after the supply has been effected, if—

- such discount is established in terms of an agreement entered into at or before the time of such supply and specifically linked to relevant invoices; and

- input tax credit as is attributable to the discount on the basis of document issued by the supplier has been reversed by the recipient of the supply

Case study:

One registered garments dealers selling Shirt to their consumer for Rs.1000 and the consumer is asking for discount on that shirt. The dealer said 30% on price. The price of shirt is Rs.1000 and now he is giving discount of Rs. 300. Now the price of the shirt is going to be 700 only and the dealer will make a invoice of Rs.700 only. the discount is adjusted at the time preparing discount. And the dealer will have to pay GST and purchasing dealer is eligible to take input tax credit only on invoice amount of Rs. 700.

Comparative analysis of different types of discount:

| Types of discount | Cash Discount | Quality Discount | Quantity discount | Performance Discount |

| Meaning | This discount is given for purchases made in cash. | Discount given for inferior quality of material supplied. | Discount given for purchases made in large numbers. | Discount given for achieving sales targets. |

| Abbreviation | CD | Rate Discount | – | – |

| Manner of adjustment in invoice | Discount is shown after total value of material sold is calculated but before calculating GST. | Not shown is invoice. Item rates itself is adjusted with value of discount. | Shown in invoice with each items of invoice after rate per unit. Rate per unit is adjusted with this discount. | Not shown in invoice as it is calculated after sale is performed. |

| When calculated | At the time of receiving cash. | Before preparing tax invoice. | At the time preparing tax invoice. | At the end of each performance period. |

| Implication on GST | GST will be paid. In case Same is declared at the time of invoice preparation GST needs to be adjusted by way of debit / credit notes. | GST need not to be paid. | GST need not to be paid. | GST will be paid. In case Same is declared at the time of invoice preparation GST needs to be adjusted by way of debit / credit notes. |

Book of Accounts under GST

Accounts and Records to be maintained under GST – Section 35 of CGST Act:

Every registered person shall keep and maintain, at his principal place of business, as mentioned in the certificate of registration, a true and correct account of—

- production or manufacture of goods;

- inward and outward supply of goods or services or both;

- stock of goods – containing particulars of the opening balance, receipt, supply, goods lost, stolen, destroyed, written off or disposed of by way of gift or free sample and the balance of stock including raw materials, finished goods, scrap and wastage thereof

- input tax credit availed;

- output tax payable and paid; and, i.e.,

- tax collected and paid

- input tax

- Register of tax invoices

- Delivery challan issued or received during any tax period

- such other particulars as may be prescribed:

- goods or services imported or exported or of supplies attracting payment of tax on reverse charge along with the relevant documents

- Invoices

- Bills of supplies

- Delivery challans

- Credit notes

- Debits notes

- Receipt vouchers

- Payment vouchers

- Refund vouchers

- Account of advances received, paid and adjustments made thereto.

Provided that where more than one place of business is specified in the certificate of registration, the accounts relating to each place of business shall be kept at such places of business:

Provided further that the registered person may keep and maintain such accounts and other particulars in electronic form in such manner as may be prescribed.

Every registered person shall keep the particulars of –

- names and complete addresses of suppliers from whom he has received the goods or services chargeable to tax under the Act;

- names and complete addresses of the persons to whom he has supplied goods or services, where required under the provisions of this Chapter;

- the complete address of the premises where goods are stored by him, including goods stored during transit along with the particulars of the stock stored therein.

Period to retention of books of accounts – Section 36 of CGSST Act:

Every registered person required to keep and maintain books of account or other records in accordance with the provisions of sub-section (1) of section 35 shall retain them until the expiry of seventy-two months from the due date of furnishing of annual return for the year pertaining to such accounts and records.

Due date of filling annual return is 31st December next to the end of relevant assessment year. This means 9 month from the end of relevant financial year. Thus, any books of accounts shall be maintained for a total period to 81 month (9 month + 72 month = 81 month) from the end of relevant assessment year.

How many different sets of accounts be maintained:

If a registered person show two different types of business to the department then he have to prepare two different sets of books of accounts.

Point to be consider by salaried class before filing ITR

1) Non reporting of interest income from savings/ fixed deposits account: These amounts can be directly mapped form the individual’s bank account statements and Form 26AS. “Non-reporting / under reporting of these amounts are apparent cases of tax evasion and calls for further investigation. Further, at times taxes are also deducted on interest income and hence, the mismatch of income by non-reporting are easily identified.

Comments:

Interest on saving account will be added in income from other sources on receipt basis (i.e. when your bank account is actually credited with interest amount) and corresponding claim of deduction may be made in Part C of the form under section 80TTA in case return in filed before 31st July.

Section 80TTA: Deduction in respect of interest on deposits in a savings account not exceeding Rs. 10,000/-

Interest on fixed deposits is to be taxed under the head income from other sources. These incomes can be offer for tax on accrual basis (i.e., it is earned) or earned basis (i.e. bank account is credited with the interest income). Take a FD interest certificate / FD statement from bank and calculate tax implication under both cases and decide whether offer it on accrual basis or on receipt basis.

2) Undocumented / fraudulent HRA claims: One of the common fraudulent practice by employees are to claim fake HRA bills without adequate supportings, like lease agreement, etc. Further there are no adequate outflows from their bank account to the extent of rent payments claimed. There may be some practical situations where employees are having rented accommodation but adequate supporting are not available as landlord is not supportive. A more practical approach should be made before claiming HRA.

Comments:

First, make judgement whether it is always beneficial to take HRA claim or take rental charges deduction under section 80GG or rent free accommodation from your employer. Thereafter, as far as possible always keep a copy of rental agreement and rent receipts in your income tax file to sustain your claim rental payments. Further, direct bank transfer (BT) from you salary account of rental expenses is more beneficial. However, in case landlord is not supportive you should withdraw your rental expenses from your bank account every month and pay the same to landlord so as to have a trail of cash flows from your bank account.

3) Claiming false 80C deductions: It is very easy for employees to claim false 80C deductions like LIC bills, Mediclaim deductions etc. inflating the value of eligible fixed deposits without actual outflow of such investments

4) Not considering income derived from all employers: People changing the job should ensure that they consider the income derived from all the employers while filing their tax return. The Tax Department already have this information based on TDS return filed by the employer and missing to report any such income can trigger inquiry against them.

5) Claiming false deduction under chapter VI-A: There are a few tax professionals who try to lure the taxpayers by promising high refund and charge them 10-25% of their refund amount. These professionals indulge in inflating or making wrong claims under various sections of Chapter VI-A like, Tax Saving Investment u/s 80C, Education loan interest – u/s 80E, Deduction form Mediclaim policies – u/s 80D, Rajiv Gandhi Equity Saving Scheme – u/s 80CCG, Donations – u/s 80G, 80GGA, 80GGC or other deductions relating to disability or medical treatment of certain illness – u/s 80DD, 80DDB, 80U.

6) With linkage of Aadhaar and PAN to all your bank account, loan account, and demat account, the I-T Department may be able to digitally verify many of your claims with the data available with them. In case of any discrepancy it can start investigation against the tax payer.

7) Making false claims under Section 10: Many salaried tax payers while filing their tax return indulge in making false claims under section 10, viz. HRA, LTA, medical reimbursement, etc. Since last year the Tax Department has started comparing the data in the tax return with the income as reported in Form 16, Form 16A, Form 26AS.

Comments:

It may be noted here that in case there is genuine difference in what you should be allowed and what is actually allowed by the employer you should prepare a reconciliation statement and same may be produced to the department online when it is asked for.

8) Inflating claim of home loan interest: Since every your bank account is linked to PAN card and aadhaar card and hence it is now not possible to hide actual interest payment from the department

9) Making false claims on capital gains: In the past a few taxpayers in a bid to save tax on their capital gains made false claims u/s 54, 54F, 54EC, etc. New the ITR Form requires to submit the details of the investment made under these sections. Further with the linkage of Aadhaar and PAN with property transactions and the financial account, it would be easy for the tax department to verify your claims electronically.

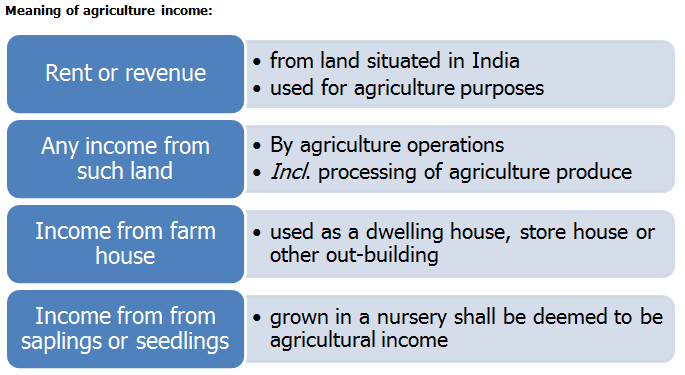

Meaning and Significance of Agriculture Income

Significance of having agriculture income:

Section 10(1) exempts agricultural income from tax. The reason of exemption of agricultural income from Central taxation into is that the constitution gives exclusive power to make laws with respect to taxes on agricultural income to the State Legislature. However in some cases agricultural income is taken consideration to determine tax on non- agricultural income.

Frequently asked question:

Q1. Whether ownership of land is prime conditions for claiming agriculture income?

Sol: , it is not necessary that the recipient of rent or revenue should be the owner of the agricultural land. If rent is received by an original tenant from sub-tenant under sub-lease or rent is received by a mortgagee in possession of agricultural land, the receipt may be “agricultural income”, if the other two conditions are satisfied that is

- Land is one which is situated in India

- Land is used for agriculture purposes

Q2. Whether agriculture income derived from foreign lands are eligible for exemption from taxation:

Sol: – Rent or revenue would be ‘agricultural income” if land is situated in India. This condition is to be fulfilled not only in sub-clause (a) but also I sub-clauses (B) and (C) of section 2(1A). Income from foreign agricultural land is outside the scope of exemption given by section 10(1) and consequently it may be taxable in India depending upon residential status of the recipient.

Q3 What are agriculture purposes to constitute income eligible for exemption?

Sol: To constitute an agriculture activity one must undertake agriculture activity. This means, one must have undertaken basic activity and subsequent activities to generating agriculture income.

| Basic operations | Subsequent operations |

| The basic 0perations would involve expenditure of human skill and labour upon the land itself and not merely on the growths from the land. | There are certain subsequent operations which are performed after the produce sprouts from the land. |

| For example: | |

| tilling of land, sowing of the seeds, planting and similar operations | weeding , digging the soil around the growth, removal of undesirable undergrowths and all operations which foster the growth and preserve the same not only from insects and pests but also from depreciation from outside, tending, pruning, cutting, harvesting and rendering the produce fit for the market. |

Mere performance of subsequent operations on the products of the land (where such products have not been raised on the land by the performance of the basic operations described above) would not be enough to characterize them as agricultural operation. Where, however, the subsequent operations are performed in conjunction with and in a continuation of the basic operations, the subsequent operations would also constitute part of the integrated activity of agriculture.

Q4: Whether growing of food grains and eatables would constitute agriculture income?

No, it includes all products, from the performance of basic as well as subsequent operations on land. These products, for instance, may be grains or vegetable or fruits including plantation and groves, grass or pasture for consumption of beast or articles of luxury such as betel, coffee, tea , spices, tobacco, etc , or commercial crops like cotton, flax ,jute, hemp, indigo, etc. All these are products raised from the land.

Q5: Give some instances of agriculture income and non agriculture income.

| Agriculture income | Non agriculture income |

| 1. Sale of replanted trees

2. Fees for grazing 3. Rent for agricultural land received from sub-tenants by mortgagee in possession. 4. Compensation received from an insurance company for damage. 5. Growing flowers and creepers. 6. Share of profit of a partner from a firm engaged in agricultural operation. 7. Interest on capital received by a partner from the firm engaged in agricultural operation. 8. The income derived from the sale of seeds is an agricultural income 9. Income derived by growing special quality of grass required for creating golf course is agricultural income. |

1. Annual annuity received by a person in consideration of transfer of agricultural land

2. Interest on arrears of rent payable in respect of agricultural land. 3. Income from sale of forest trees, fruits and flowers growing on land naturally. 4. Income of salt produced by flooding the land with sea water. 5. Profit accruing from the purchase of a standing crop and resale of it after harvest. 6. Remuneration received by a managing agent at a fixed percentage of net profit from company having agricultural income. 7. Interest received by a money-lender in the form of agricultural produce. 8. Dividend paid by a company out of its agricultural income. 9. Income from fisheries. 10. Royalty income of mines. 11. Income from butter and cheese-making. 12. Income from poultry farming. 13. Income from supply of water. 14. Income from sale of tender forms by the assessee. 15. Income from toddy tapping 16. |

Case study on anti profiteering measure

What is anti – profiteering measure:

As per section 171 of CGST act :- (1) Any reduction in rate of tax on any supply of goods or services or the benefit of input tax credit shall be passed on to the recipient by way of commensurate reduction in prices. (2) The Central Government may, on recommendations of the Council, by notification, constitute an Authority, or empower an existing Authority constituted under any law for the time being in force, to examine whether input tax credits availed by any registered person or the reduction in the tax rate have actually resulted in a commensurate reduction in the price of the goods or services or both supplied by him. (3) The Authority referred to in sub-section (2) shall exercise such powers and discharge such functions as may be prescribed.

How the reduction in rate of tax is calculated:

Reduction in rate of tax is considered to have exist when and only when total tax rate from manufacturing point to point of consumption is reduced, i.e., gross effective rate of tax on all stages of sale is actually reduced. This can be understood with an example:

Suppose we consider here the case of car to identify whether there is, in actual, reduction of rate of tax and if so, how much. For the this we need to compare tax expenditure in pre GST and post GST scenario in the below table:

| Particulars of taxes applicable |

Pre GST |

Post GST |

Benefit to pass on |

| Excise Duty |

12.5 |

– |

|

| NCCD |

1 |

– |

|

| Auto cess |

.125 |

– |

|

| Infra cess |

1 |

– |

|

| CST (.05% on 14.625%) |

.0073125 |

– |

|

| VAT/GST |

16.622 |

29 |

|

| Total |

31.254 |

29 |

2.2543 or Say 2% |

Thus, in case there in 2% reduction in prices of cars is sufficient in compliance with the provisions of this act.

How the benefit of input tax credit is passed on to recipient:

Now, a question arise here is – how the benefit of ITC availed on account of excise duty, NCCD etc on the transition period is passed on the customer which in post GST scenario is not available to dealer.

Here, it is worth of noting that the entire scheme of GST is ITC based i.e. the recipient of the goods and services takes credit of GST paid by him on purchase of goods and services and uses such ITC while discharging GST output tax liability on supply of goods and services. Thus, in any case purchaser is going to purchase the car with ITC benefit and thus no extra benefit needs to be passed on the buyer.

Concluding remarks:

Though the anti-profiteering provision is in the law to curb mal-practices and is intended to operate against the supplier of goods / services. However, supplier shall not be harassed by using the cannons of section 171 of the GST law and if factual matrix proves that there is no unjust enrichment availed by the supplier. To be more precise, adjudication under section 171 is more on facts rather than law. The statutory provision is only an enabling provision to step in, if there is a case of anti-profiteering. Once it is admitted, the facts shall be deciding factor keeping the principles of legislative intention in mind. The Authority shall have to do so based on facts without going into much of legal interpretation.