Concessional/interest-free loans from employer

If an employer grants loan to an employee for personal purposes, and such loans are either interest-free or carry concessional rates of interest (when compare with normal rates generally prevalent), rule 3(7)(i) classifies the resulting benefit as a ‘fringe benefit’ falling under section 17(2)(viii) of the Act.

Contents of the sub-rule – The perquisite is taxable on the following basis-

- The value of the benefit to the assessee resulting from the provision of interest-free or concessional loan for any purpose made available to the employee or any member of his household during the relevant previous year by the employer or any person on his behalf shall be determined as the sum equal to the interest computed at the rate charged per annum by the State Bank of India, constituted under the State Bank of India Act,1955 as on the 1st day of the relevant previous year in respect of loans for the same purpose advanced by it on the maximum outstanding monthly balance as reduced by the interest ,if any ,actually paid by him or any such member of his household.

- In the following cases, the perquisite is not chargeable to tax-

– if such loan is made available for medical treatment in respect of diseases specified in rule 3A (the exemption is however, not applicable to so much of the loan as has been reimburses to the employee under any medical insurance scheme); or

– where the amount of loans are petty not exceeding in the aggregate Rs.20,000.

A drafting error in the sub-rule

The use of the expression ’during the relevant previous year ‘in the opening part of the sub-rule, if literally interpreted, will mean that the benefit resulting from the provision of interest-free or concessional loan is taxable only once, i.e., for the previous year in which the loan was given by the employer, and not in successding previous year if the loan continues to be outstanding. This was never the intention. Either the expression ‘during the relevant previous year’ should be omitted , or substituted by ‘during the relevant previous year and earlier previous year.’

Thus, for the purpose of computing the value of the benefit resulting from the provision on interest-free or concessional loans, the rule as amended with the effect from 1-4-2004, prescribes the following requirements and aspects:

| The loan may have been made available by the employer or any other person on his behalf, | The sub-rule states that the loans must have been ’made available’ to the employee or to his household members, by the employer or any other person on his behalf.The loans need not necessarily be ‘granted’ or ‘provided’ by the employer only. No doubt, if the loan is granted or provided by the employer out of his own funds, it would also be a case where the loan has been ‘made available’. In addition, where the employer assists the employee in obtaining a loan from an external source , like standing surety or guarantee for such loans, the case will fall under the category where loan has been ‘made available’. |

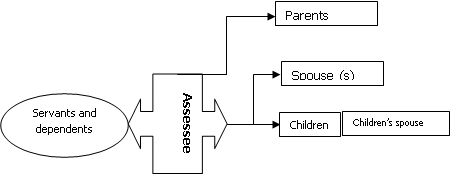

| The loan may be provided to employee or to any member of his household | MEMBER OF HOUSEHOLD:

Key principle: In order to constitute a member of a household, there must be some degree of permanence in the stay of the member along with assessee employee. Hence, person like guests and visitors can not constitute as member of a household. List of member as enumerated under rule 3, explanation (iv) is given below: |

|

|

| Certain types of loans are excluded |

LOANS FOR MEDICAL TREATMENT – if an employee has taken any loan for treatment of certain prescribed ailments in approved hospitals, the rule provides that no value of such perquisite will be charged to tax.Situation when above exclusion will not be available:However, the provision to the rule stipulates that his exemption will not available to so much of the loan as has been reimbursed to the employee under any medical insurance scheme. Case: The employee had taken a loan of Rs.1 lakh for medical treatment. Later gets insurance money of Rs.50,000 in respect of such treatment, the exemption will be available only to the loan component of the balance, viz., Rs.50,000, and the value of the perquisite will be computed at the prescribed rates for the balance amount of Rs.50,000. Departmental clarification: The department has clarified that, where medical insurance reimbursement is received, the perquisite value at the prescribed rate shall be charged from the date of reimbursement on the amount reimbursed but not repaid against the outstanding loan taken specifically for this purpose. PETTY LOANS – where the amount of loans are petty and do not in the aggregate exceed Rs.20,000, there will be no taxable perquisite. The limit applies to the aggregate of all loans which are petty and which are taken during a particular previous year, either by the employee or a member of his household. |

| Prescribed rates for loan | PRESCRIBED RATES – under the rule , the difference between interest computed at the ‘prescribed rates’ and the interest, if any, actually paid , is to be treated as the value of the perquisite. The ‘prescribed rates‘ for all types of loans have been fixed as rate charged per annum by the State Bank of India as on the 1st day of the relevant previous year , in respect of loans for the same purpose advanced by it. |

| Method of computation of the value of the perquisite | METHOD OF COPUTATION – The balance for each type of loan as on the last day of each month in the financial year must be taken and aggregated, and on the total amount arrived at interest must be calculated for one month at prescribed rate. From the amount so arrived at, the interest if any actually paid should be deducted, so as to arrive at the value of the perquisite |

IILUSTRATION – if an employee has taken a loan of Rs. 1 lakh from the employer for medical treatment, and later obtains insurance money of Rs, 50,000-

- If he repays Rs. 50,000 to the employer as repayment of loan ,the outstanding loan will be taken as Rs. 50,000;

- If he does not utilise any part of the insurance money towards repayment of loan taken from the employer, the outstanding loan may continue to be Rs. 1 lakh;

- If he repays Rs.30,000 out of the insurance money towards repayment of loan to employer and utilises the balance for some other purpose, the outstanding loan may be taken as Rs.70,000.