Filing of Income Tax Return (ITR) is a legal obligation of every person whose total income for the previous year has exceeded the maximum amount that is not chargeable for income tax under the provisions of the I.T Act, 1961. [Read More]

Calculation of HRA Exemption Employees generally receive a house rent allowance (HRA) from their employers. HRA is an allowance and is subject to income tax. An employee can claim exemption on his HRA under the Income Tax Act if he stays [Read More]

INCOME TAX RATE CHART FY 2012-2013 A. Normal Rates of tax: 1. The Total Income is less than Rs. 2,00,000/-. Nil 2. The Total Income is between Rs. 2,00,000/- and Rs. 5,00,000/- 10 per cent of the amount by which the total income exceeds Rs.2,00,000/- [Read More]

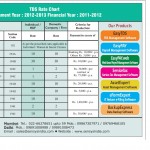

Due dates for TDS Quarterly Return Quarters Due date for Form 24Q/26Q/27Q Due date for Form 27EQ Quarter 1 (April-June) 15th July 15th July Quarter 2 (July-September) 15th October 15th October Quarter 3 (October-December) 15th January 15th January Quarter [Read More]

As per the latest press release at income tax website (i) it will not be mandatory for agents of non-residents, within the meaning of section 160(1) (i) of the Income –tax Act, if his or its total income exceeds ten [Read More]

Income tax return filing due date for all assesses who are required to file by 31st July 2012 has been extended to 31st August 2012. As per Income Tax Notification dated 31st July 2012, this has been done on consideration [Read More]

Dear All We are excited to announce our own presence in blogging world. On this blog, we will keep everybody posted and informed about various statutory compliance changes in HR/Payroll/Taxation world. We will also leverage this platform to keep you [Read More]