Key changes in ITRS’ form disclosure requirement With invent of GST tax regime and other regulatory requirements various changes have been made in ITR forms. It is recommended that these changes should be properly understood before start filing ITR forms. [Read More]

Applicability of ITR forms for AY 2018-19 With the 31st July, 2018 is approaching nearby you are rushing behind your consultant for completing self-assessment process and filling your ITR. As you are aware that forms you submit to the department [Read More]

Change of Email ID and mobile nos in GSTN Significance of E-mail ID and phone number in GSTN: E-mail ID and mobile nos. are media to communicate with GSTN instantly for different purposes. These are required for the following purposes: [Read More]

Non applicability of Section 44AD in certain cases Substituted by the Finance Act, 2016, w.e.f. 1-4-2017 [Subsection 4 of section 44AD]: Where an eligible assessee declares profit for any previous year in accordance with the provisions of this section and [Read More]

Types of discounts and its role in GST Meaning of discount under GST: Discounts means a reduction made from the gross amount or value of something: such as, a reduction made from a regular or list price offering customers a ten percent [Read More]

Book of Accounts under GST Accounts and Records to be maintained under GST – Section 35 of CGST Act: Every registered person shall keep and maintain, at his principal place of business, as mentioned in the certificate of registration, a [Read More]

Point to be consider by salaried class before filing ITR 1) Non reporting of interest income from savings/ fixed deposits account: These amounts can be directly mapped form the individual’s bank account statements and Form 26AS. “Non-reporting / under reporting [Read More]

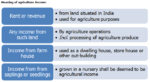

Meaning and Significance of Agriculture Income Significance of having agriculture income: Section 10(1) exempts agricultural income from tax. The reason of exemption of agricultural income from Central taxation into is that the constitution gives exclusive power to make laws with [Read More]

Case study on anti profiteering measure What is anti – profiteering measure: As per section 171 of CGST act :- (1) Any reduction in rate of tax on any supply of goods or services or the benefit of input tax [Read More]

Chennai New Profession tax slab 2018 The Profession Tax assessment and collection is coming under the provision of tax on professions, trades, calling & employments, under the Tamil nadu Municipal Laws (Second Amendment) Act 1998 Profession Tax is higher source [Read More]