Enclosed is all the Tie-Up Hospital that are glad to extend & have expressed their willingness to provide SST services to our beneficiaries in Odisha.

ALL-SST-Tie-up-Hospital-Odisha <<< Download<<<

SOURCE BY: PRAKASH CONSULTANCY SERVICES

Enclosed is all the Tie-Up Hospital that are glad to extend & have expressed their willingness to provide SST services to our beneficiaries in Odisha.

ALL-SST-Tie-up-Hospital-Odisha <<< Download<<<

SOURCE BY: PRAKASH CONSULTANCY SERVICES

The government has approved an 8.5% rate of interest on employees’ provident fund for 2020-21 fiscal, Just ahead of Diwali, this is good news for over five crore subscribers of the Employees Provident Fund Organisation (EPFO).

The 8.5% rate of interest on provident fund deposits for the last financial year was decided by the EPFO’s apex decision-making body Central Board of Trustees (CBT) headed by the Labour Minister in March this year.

“The rate of interest on EPF for 2020-21 has been ratified by the Ministry of Finance and now it would be credited into the accounts of over five crore subscribers.”

Download from the above link!

SOURCE BY: PRAKASH CONSULTANCY SERVICES

Appended below is the Pan India Compliance calendar for the month of November 2021, employer is under obligation to contribute towards some of the above-mentioned compliances for the welfare of the employees. Each of these compliances is again governed by a set of rules and formulas. It is proven to be a deliberate attempt to violate the provisions of the law, there could be imprisonment of the employer. Please, comply with the same in time to avoid any future non-compliance so that hefty penalties and fines are not charged by the respective dept.

CLICK HERE FOR THE FULL COMPLIANCE CALENDAR OF MONTH NOVEMBER 2021: Compliance Calendar Nov 21 PDF

|

|

Due dates for the Month of November 2021

|

|

7th

|

INCOME TAX – TDS Payment for October. |

|

10th

|

GST – Return of authorities deducting tax at source – GSTR 7 for October. – Details of supplies effected through e-commerce operator and the amount of tax collected – GSTR 8 for October. |

|

11th

|

GST – Details of outward supplies of taxable goods and/or services effected – GSTR 1 for October. |

|

13th

|

GST – Quarterly Return GSTR 1 for July to September 2021 turnover not exceeding Rs. 1.5 crore. – Return for Input Service Distributor – GSTR 6 for October. |

|

15th

|

Providend Fund – PF Payment for October. ESIC – ESIC Payment for October. |

|

20th

|

GST – Monthly return on the basis of finalization of details of outward supplies and inward supplies along with the payment of the amount of tax – GSTR 3B for October. – Return for Non-Resident foreign taxable person – GSTR 5 for October. |

|

22nd

|

GST – GSTR 3B for October if turnover below Rs. 5 Crore for Gujrat, Madhya Pradesh, Chattisgarh, Maharashtra, Telangana. Andhra Pradesh, Karnataka, Goa, Kerala, Tamil Nadu, Puducherry, Dadra & Nagar Haveli. |

|

24th

|

GST – GSTR 3B for October if turnover below Rs. 5 Crore for the Rest of India. |

|

28th

|

GST – Details of Inward Supplies to be furnished by a person having UIN and claiming refund – GSR 11 for October. |

|

30th

|

PROF. TAX

– Monthly Return for Tax Liability of Rs. 100,000 & above. |

|

30th

|

INCOME TAX

– Due date for filing return of income for AY: 2021-22 or assessees to whom tax Audit is applicable. |

|

Software Solutions Available on:

TDS | PAYROLL | WEB PAYROLL | WEB HRMS | XBRL | FIXED ASSET |INCOME TAX| SERVICE TAX | DIGITAL SIGNATURE | ATTENDANCE MACHINE & CCTV | DATA BACKUP SOFTWARE | PDF SIGNER |

|

|

Sensys Technologies Pvt. Ltd.

HO: 904, 905 & 906, Corporate Annexe, Sonawala Road, Goregaon East, Mumbai- 400 063. Tel.: 022-6820 6100| Call: 09769468105 / 09867307971 Email: sales@sensysindia.com | Website: http://www.sensysindia.com Branches: Delhi & NCR | Pune | Bangalore | Hyderabad | Ahmedabad | Chennai | Kolkata |

|

|

Visit our BLOG for the latest news and updates related to XBRL, Income Tax, HR & Payroll, PF / ESIC / TDS / PT, etc. Click here to visit Sensys BLOG

|

|

The government of Madhya Pradesh has issued a circular to all jurisdictional officers in Madhya Pradesh under The Inter-State Migrant Workmen (Regulation of Employment and Conditions of Service) Act, 1979. As per the circular, the labor department has directed all jurisdictional officers to run a special campaign from 1st July 2021 to 31st July 2021 for registration of major employers and license to the contractor and make all the employers or institutions and labor organizations of their jurisdiction aware of instructions as mentioned in the circular.

Synopsis

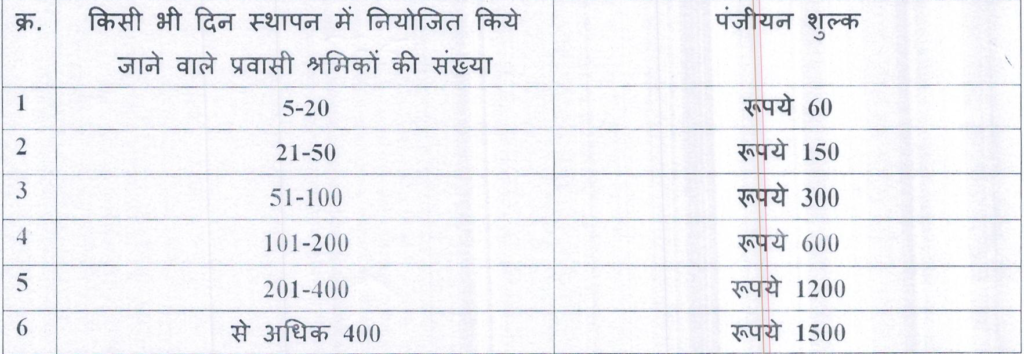

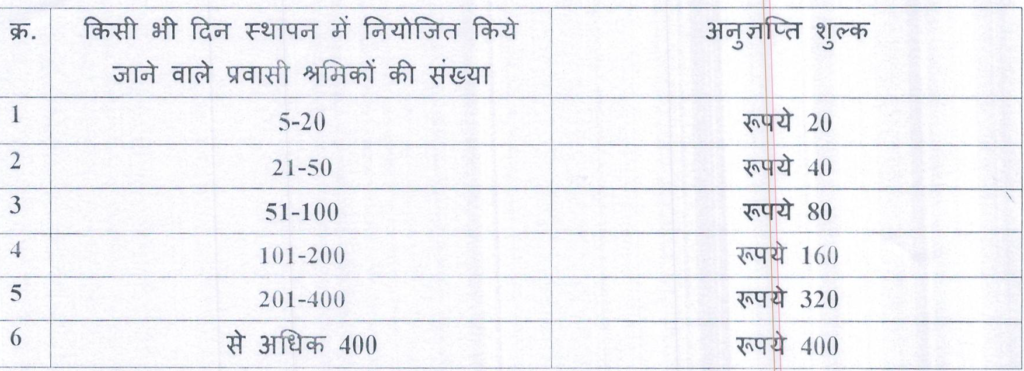

All Employer wherein on any day or having more than 5 migrant workers will have to register & pay a nominal fee for Registration per the chart given below

Also the License fees as per the chart

CLICK ON THE BELOW LINK FOR MORE DETAILED INFORMATION:

Courtesy: PRAKASH CONSULTANCY SERVICE

Maharashtra Minimum Wages have been revised from 1st July 2021 to 31st December 2021.

CLICK ON THE BELOW LINK FOR MORE DETAILED INFORMATION:

Zone I shall comprise of the areas falling within the limits of all Municipal Corporations, Cantonment areas, and Industrial areas within a 20 Kilometres radius from all Municipal Corporations limit.

Zone II shall comprise the areas falling within the limits of all “A” and “B” grade Municipal Councils.

Zone III shall comprise all other areas in the State, which are not included in Zone I and II.

Courtesy: PRAKASH CONSULTANCY SERVICE

Kindly refer to Letter No.X-11/14/03/2017-P&D dated 14.10.2020 on the above-cited subject wherein the district-wise Phased Programme of Implementation for the year 2020-21 was conveyed as per Vision – 2022. The targets for 2020-21 could not be achieved due to the non-completion of medical arrangements during the COVID pandemic. Now, a new consolidated target for 2021-22 is enclosed which includes the pending districts that are not notified during the year 2020-21 in the target of notification.

It is also to inform you that the Code on Social security, 2020 (Act 36 of 2020) has been notified. The effective date of implementation is also expected to be notified shortly. The code subsumes the ESI Act, 1948 along with eight other central enactments in the field of Social Security. Once notified, the entire area of the country shall be implemented for the purposes of the ESI Scheme. Therefore, it is imperative to make medical arrangements in all areas within this financial year itself.

The targets for the years 2021-22 are enclosed as Annexure -A with the request that necessary steps may be taken on priority for implementing the scheme in the districts shown in the Annexure.

In view of the above, the State Govt. is requested to take steps to complete the medical arrangement in the districts for delivery of medical care to the Insured Persons and their family members so as to enable ESIC to take further action for the issue of notification well in time for implementing the Scheme.

Partially to the entire area of the district pending for notification – 176

Non Implemented to the entire area of the district pending notification – 147

CLICK ON THE BELOW LINK FOR MORE DETAILED INFORMATION:

ESIC-List-of-Implementing-of-Non-Covered-Areas-Target-Date-31-03-2022

Courtesy: PRAKASH CONSULTANCY SERVICE

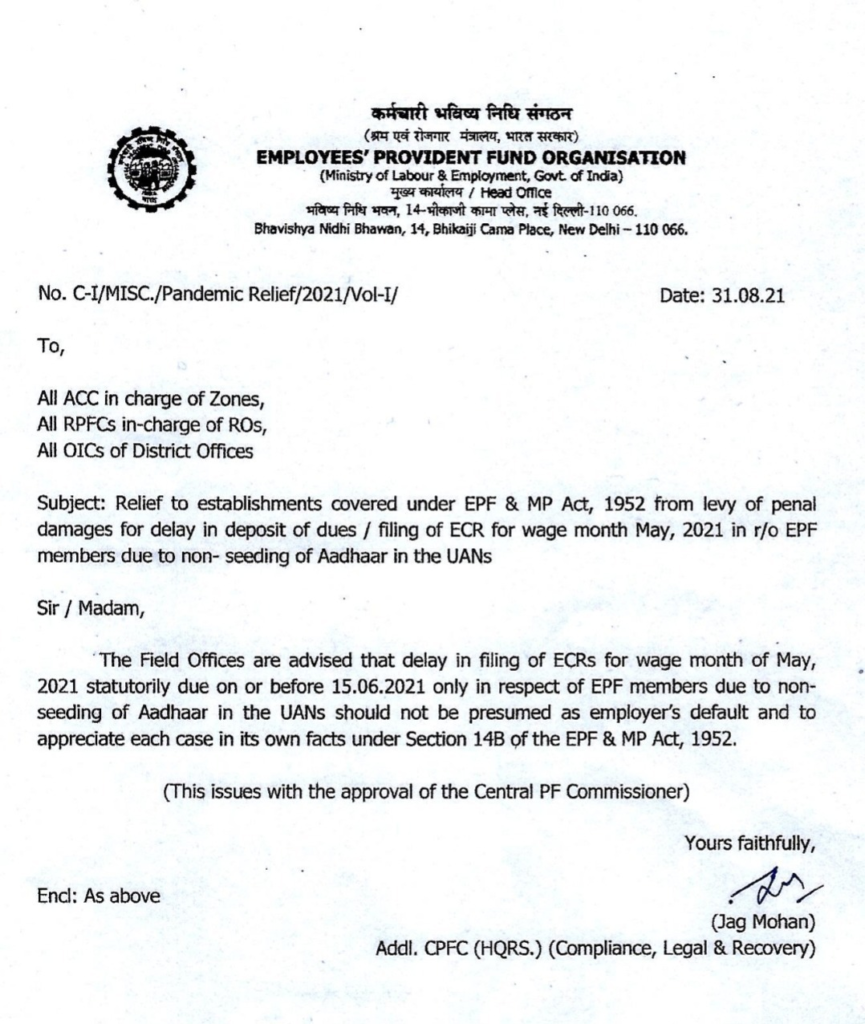

Good News from EPFO & relief to the Employers from levy of Damages for the delay in deposit of challan fo the month of May 2021 due to Non- the seeding of Aadhar in UANs should not be presumed as employers default and have to appreciate each case in its own facts under the respective sections of 14B.

Courtesy: PRAKASH CONSULTANCY SERVICE

Haryana Minimum Wages have been release 1st Sep 2021 effective from 1st July 2021 to 31st Dec 2021

CLICK ON THE BELOW LINK FOR MORE DETAILED INFORMATION:

Harayana-Minimum-Wages-1st-July-2021-to-31st-Dec-2021

Courtesy: PRAKASH CONSULTANCY SERVICE

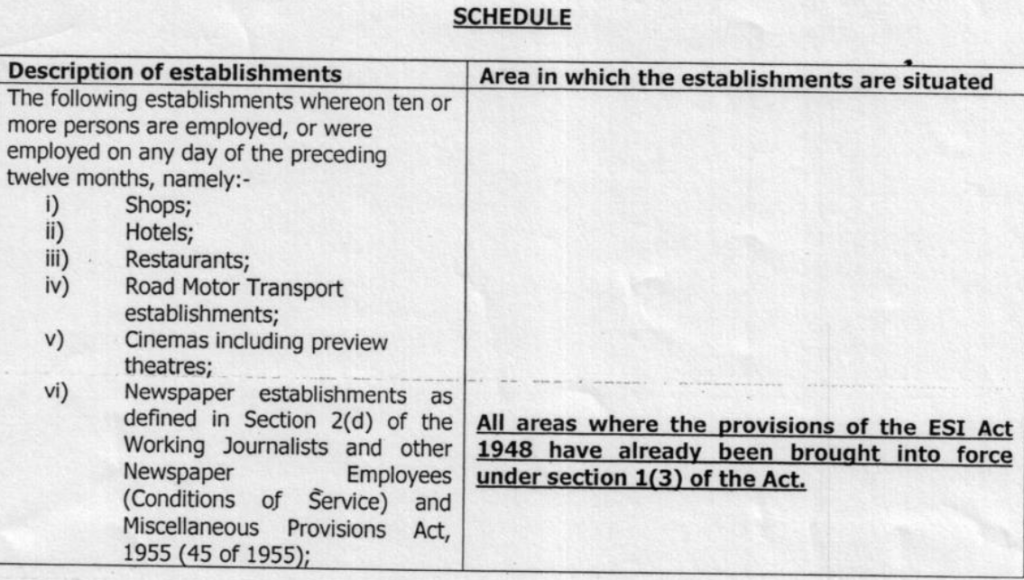

A notification of the Government of Manipur vide even number dated 29“ December 2020, the State Government in consultation with the Employees’ State Insurance Corporation and with the approval of the Central Government gave notice to is the intention to extend the provisions of the Employees’ State Insurance Act, 1948 (34 of 1948) to Municipal Corporation, Municipal Board, Municipal Council, and other Local bodies controlled by the State Government.

And whereas, no objections and suggestions have been received within the said period of 1 (one) the month of the said notification.

In the exercise of the power conferred by sub-section (5) of Section-1 of the Employees’ State Insurance Act, 1948 (34 of 1948), and in supersession of all previous notification issued In this regard, the State Government of Manipur, and in consultation with the Employees State Insurance Corporation and with the approval of the Central Government hereby extends the provisions of the said Act to the classes of establishment specified in Column (1) and situated within the areas specified in Column (2) of the Schedule in the State of Manipur as detailed below with immediate effect.

CLICK ON THE BELOW LINK FOR MORE DETAILED INFORMATION:

esic-provision-extended-to-certain-establishments-and-local-bodies-in-Manipur

Courtesy: PRAKASH CONSULTANCY SERVICE