e–Commerce under GST What is e-Commerce under GST? As per section 2(41) of revised GST model law electronic commerce means supply of goods and/or services including digital products over digital or electronic network. This means all kind of supplies which [Read More]

HSN Code / SAC under GST What is HSN? HSN stands for harmonised System of nomenclature. The HSN is the codification of all tradable commodities into 20 broad sections with each chapter containing commodity of similar nature. As we know [Read More]

Invoicing Procedure Under GST With the preparation to migrate existing taxpayers under GST regime is going on, the next step which is really worth for business man to know is how and when to issue a tax invoice. Here, is [Read More]

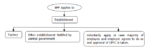

GST – Return submission and verification procedure Everyone have lot of expectations from GST with is expected to subsist in the upcoming financial year 2017. There are expectation of transparent governance, ease of doing business and free movement of information [Read More]

SMOOTH TRANSITION TO GST What is migration? Under GST regime various central level taxes and state level taxes are summoned into one tax. Hence, for the smooth transition it is essential to migrate all existing assesses under various acts under [Read More]

HOW TO FILE GST RETURN The biggest reform in the Indirect tax is now a step forward. Everyone is trying to know how his business process are going affected due to its likely upcoming from 1st April 2017. Here is [Read More]

Due dates for the Month of December 2016 5th Service Tax** – Service Tax payments by Companies for November ** If Service Tax Payment is done online, then the due date of payment of service tax is 6th. Central Excise** [Read More]

Due dates for the Month of November 2016 5th Service Tax** – Service Tax payments by Companies for October ** If Service Tax Payment is done online, then the due date of payment of service tax is 6th. Central Excise** [Read More]

THE EMPLOYEES’ PROVIDENT FUNDS AND MISCELLANEOUS PROVISIONS ACT, 1952 Section 1. Short title, extent and application.- (1) This Act may be called the Employees‟ Provident Funds and Miscellaneous Provisions Act, 1952. (2) It extends to the whole of India except [Read More]

Due dates for the Month of October 2016 5th Service Tax** – Service Tax payments by Companies for September – Service Tax payments by other than companies for July to September** If Service Tax Payment is done online, then the [Read More]