Facts of the case: As per provisions of section 10(5) of the Act, only that reimbursement of travel concession or assistance to an employee is exempted which was incurred for travel of the individual employee or his family members to [Read More]

Facts of the case: Residential status: On a worksheet submitted by the assessee along with Form-16, the assessee claimed that he comes under the NOR (Not Ordinarily Resident) category for the assessment year 2010-11 based on particulars of the days, [Read More]

Facts of the case: The assessee in a development office of LIC. The issue that arises here is – whether the incentive bonus received by DO-LIC is a salary income. If so, whether amount so received by him is entitled [Read More]

Computation of salary income of a Czech national employed with Skoda Auto AS, a company incorporated in Czechoslovakia and is currently under deputation to Skoda Auto India (P.) Ltd: Income tax return filed on : 31-7-2006, Basic Salary: Bonus: Total [Read More]

Computation of salary income of a Czech national employed with Skoda Auto AS, a company incorporated in Czechoslovakia and is currently under deputation to Skoda Auto India (P.) Ltd: Income tax return filed on : 31-7-2006, Basic Salary: Rs. 47,31,650 [Read More]

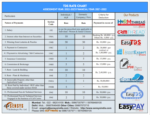

Due dates for the Month of April 2021 10th GST – Return for authorities deducting tax at source – GSTR 7 for February – Details of supplies effected through e-commerce operator and the amount of tax collected – GSTR 8 [Read More]

Total rental income Standard Deduction @ 30% Interest on borrowed capital Rs 9,00,000/- Rs 2,70,000/- Rs 21,62,120/- Loss under the head House Property Rs 15,32,120/- Details of rent income and issue involved: The above rent was, on the basis [Read More]

The assessee is in the business of film distribution in the name of M/s Sukrit Pictures. The assessee has paid an amount of Rs.2 crores as Minimum Guarantee Royalty (MGR) and has not deducted TDS. The Assessing Officer held that [Read More]