07th |

TDS | TDS Payment for November 2022. |

10th |

GST | Return for authorities deducting tax at source – GSTR 7 for November 2022. |

| Details of supplies effected through e-commerce operators and the amount of tax collected – GSTR 8 for November 2022. | ||

11th |

GST | Details of outward supplies of taxable goods and/or services effected – GSTR 1 for November 2022. |

13th |

GST | Invoice Furnishing Facility (IFF) for November 2022 in lieu of GSTR 1 for QRMP Filers. |

| Return for Input Service Distributor – GSTR 6 for November 2022. | ||

15th |

P.F. | P.F. Payment for November 2022. |

| ESIC | ESIC Payment for November 2022. | |

| Income Tax | Advance Tax 3rd Installment for F.Y. 2022-23. | |

20th |

GST | GSTR 3B for November 2022 if aggregate turnover is above ₹ 5 crores. |

| Return for Non-Resident foreign taxable persons – GSTR 5 for November 2022. | ||

22nd |

GST | GSTR 3B for November 2022 if aggregate turnover is below ₹ 5 crores for Andaman & Nicobar Islands, Andhra Pradesh, Chhattisgarh, Dadra & Nagar Haveli, Gujarat, Goa, Karnataka, Kerala, Lakshadweep, Madhya Pradesh, Maharashtra, Puducherry, Tamil Nadu, Telangana. |

24th |

GST | GSTR 3B for November 2022 if turnover is below ₹ 5 crores for the Rest of India. |

25th |

GST | Monthly Payment for November 2022 through Challan PMT 06 for QRMP filers. |

31st |

GST | Annual Return – GSTR 9 & Reconciliation Statement in GSTR 9C as applicable for Financial Year 2021-22. |

| Prof. Tax | Monthly Return Tax Liability of ₹ 1,00,000/- & above for November 2022. | |

|

Software Solutions Available on: TDS | PAYROLL | WEB PAYROLL | WEB HRMS | XBRL | FIXED ASSET |INCOME TAX| SERVICE TAX | DIGITAL SIGNATURE | ATTENDANCE MACHINE & CCTV | DATA BACKUP SOFTWARE | PDF SIGNER |

||

|

Sensys Technologies Pvt. Ltd. HO: 904, 905 & 906, Corporate Annexe, Sonawala Road, Goregaon East, Mumbai- 400 063. |

||

07th |

TDS | TDS Payment for October 2022. |

10th |

GST | Return for authorities deducting tax at source – GSTR 7 for October 2022. |

| Details of supplies effected through e-commerce operators and the amount of tax collected – GSTR 8 for October 2022. | ||

11th |

GST | Details of outward supplies of taxable goods and/or services effected – GSTR 1 for October 2022. |

13th |

GST | Quarterly Return GSTR 1 for July to October 2022 for QRMP filers, whose turnover not exceeding ₹ 5 crores. |

| Return for Input Service Distributor – GSTR 6 for October 2022. | ||

15th |

P.F. | P.F. Payment for October 2022. |

| ESIC | ESIC Payment for October 2022. | |

20th |

GST | GSTR 3B for October 2022 if aggregate turnover is above ₹ 5 crores. |

| Return for Non-Resident foreign taxable persons – GSTR 5 for October 2022. | ||

22nd |

GST | GSTR 3B for October 2022 if aggregate turnover is below ₹ 5 crores for Andaman & Nicobar Islands, Andhra Pradesh, Chhattisgarh, Dadra & Nagar Haveli, Gujarat, Goa, Karnataka, Kerala, Lakshadweep, Madhya Pradesh, Maharashtra, Puducherry, Tamil Nadu, Telangana. |

24th |

GST | GSTR 3B for October 2022 if turnover is below ₹ 5 crores for the Rest of India. |

25th |

GST | Monthly Payment for October 2022 through Challan PMT06 for QRMP filers. |

30th |

Prof. Tax | Monthly Return Tax Liability of ₹ 1,00,000/- & above for October. |

| Income Tax | Return for Income from Companies and assesses to whom Transfer Pricing is applicable for F.Y. 2021-22. | |

|

Software Solutions Available on: TDS | PAYROLL | WEB PAYROLL | WEB HRMS | XBRL | FIXED ASSET |INCOME TAX| SERVICE TAX | DIGITAL SIGNATURE | ATTENDANCE MACHINE & CCTV | DATA BACKUP SOFTWARE | PDF SIGNER |

||

|

Sensys Technologies Pvt. Ltd. HO: 904, 905 & 906, Corporate Annexe, Sonawala Road, Goregaon East, Mumbai- 400 063. |

||

If anyone wonders whether corporate training is essential to employees, they should start wondering if a user manual is required to learn about a piece of heavy machinery. Well, the answer is as clear as a day, it is fundamental. Along with being significant, it is rather a lot beneficial, too. As a person who is about to embark on the corporate world, they must have an idea about the things that go down here and the way the work is carried around here. Also, they must be well aware of the all-around rules and regulations and company-exclusive conditions.

Corporate training makes it easier for an employee to fit in the company space and create a self-proclaimed identity amongst the team. It is a way of understanding one’s strengths and weaknesses and certainly helps one emphasize the areas of improvement. This could be contributed by an internal team or can be provided by an externally hired team.

Getting into detail about the benefits of this training:

Pre-instilled knowledge.

They were generally called ‘Knowledge Transfer’ or ‘KT’, in the corporate world. As the name suggests, it is the transfer or sharing of knowledge from a senior to a junior; a newcomer. This entitles nurturing of basic work knowledge then the employee will conduct into them. In such a case, the employee is not entirely unaware of his role. Even though guidance is still required, it wouldn’t be a lot of pressure because the employee has a gist about their tasks. This could be done before joining or while onboarding.

Improvement in team strength.

While KT, the bond between the senior employee and the newcomer blooms. This bond further enhances creating excitement among the team, to have a newcomer who is already efficient. This creates a good rapport amongst the team which delivers good results. The employee would feel useful and contribute more to the team wanting to achieve higher success, which ahead motivates the other members. All in all, everyone grows with the flow of new blood in the team.

Social awareness.

In the training, a part of the training would be etiquette. In a world where people earn, etiquettes are what makes a person remarkable and memorable. A person who behaves well and is a faster worker, a sweet talker, a charmer, etc, is the one who succeeds in this social network. As networking is an important aspect of growth, the employee learns how to behave, capture good deals and make good impressions, creating a good name for themself and the company. This is beneficial as the employee becomes ready to face an obstacle without fear and succeeds well.

Motivation and continuation.

When the seniors share their knowledge with the juniors, a sense of achievement forms within them that keeps them motivated and makes them want to perform better and be good role models to the juniors. This motivation also makes them continue working for the company which then reduces the number of attritions. This training is an easy way to make the senior employees motivated without putting in a lot of effort. This makes it easier for the juniors to communicate with the seniors and the seniors enjoy the delight of being a teacher.

Operational business plans.

When the employee is trained, it is expected of them to receive the knowledge and put it to good use. The company invests time in them, anticipating a worthy outcome. Given that the employee is pre-informed of their duties, they formulate action plans that will help the company grow. They have new ideas and they match them up with the new techniques and things they learned during the training. This surely makes good proposals and keeps the team engaged in formulating new ideas.

Engaged in the process.

One can only be involved in the process if one knows what the process is. Since the employee has already been given knowledge and sheds light on the company tasks, ideologies, tagline, etc, they can now be incorporated into the process. After the training, they are well accustomed and comprehend the process easily. They immerse themselves in the task apart from just being an onlooker, further, learning completely about each task ahead of the process. In the long run, they would excel at all the processes sooner making them want to learn more and indulge more, and the loop goes on.

Reality check.

This point is made not in a way to criticize an employee but as a sort of conclusion being conveyed to them by themselves. During the entire time of training, they have a chance to understand and explore various things taught by someone very experienced and also understand what they like the most. At the same time, they can learn to acknowledge what they do best and what they are not fit for. This gives them a clear mirror of what tasks they should focus on and what process they have a good understanding of. This can help them balance themselves and create equilibrium within all the tasks to excel at all of them.

Pushing limits.

Would a person who recently learned skating, keep the board aside? Definitely, not. The same is the case with everyone who learns new things. Just like the skateboarder trying to clear difficult stages by pushing themselves, the same thing happens with employees. Once they learn one thing, they keep pushing their limits, while practicing and trying to excel at it, by challenging themselves to do better. This is a self-challenge but the one who bears the fruit is not just the employee but also the company.

Concluding, it’s clear how the benefits of training don’t work just for the juniors but also for the seniors who teach them. It also creates a good bond while sharing knowledge. All in all, it seems like a very good option to keep the company growing and the employees going hand-in-hand to keep pushing themselves to achieve greater success.

07th |

TDS | TDS Payment for September 2022. |

10th |

GST | Return for authorities deducting tax at source – GSTR 7 for September 2022. |

| Details of supplies effected through e-commerce operators and the amount of tax collected – GSTR 8 for September 2022. | ||

11th |

GST | Details of outward supplies of taxable goods and/or services effected – GSTR 1 for September 2022. |

13th |

GST | Quarterly Return GSTR 1 for July to September 2022 for QRMP filers, whose turnover not exceeding ₹ 5 crores. |

| Return for Input Service Distributor – GSTR 6 for September 2022. | ||

15th |

P.F. | P.F. Payment for September 2022. |

| ESIC | ESIC Payment for September 2022. | |

| TDS | TCS Quarterly Statements (Other than Government Deductor) for July to September 2022. | |

18th |

GST | Quarterly Statement for composition taxable person – CMP 08 for July to September 2022. |

20th |

GST | GSTR 3B for September 2022 if aggregate turnover is above ₹ 5 crores. |

| Return for Non-Resident foreign taxable persons – GSTR 5 for September 2022. | ||

22nd |

GST | GSTR 3B for September 2022 if aggregate turnover is below ₹ 5 crores for Andaman & Nicobar Islands, Andhra Pradesh, Chhattisgarh, Dadra & Nagar Haveli, Gujarat, Goa, Karnataka, Kerala, Lakshadweep, Madhya Pradesh, Maharashtra, Puducherry, Tamil Nadu, Telangana. |

24th |

GST | GSTR 3B for September 2022 if turnover is below ₹ 5 crores for the Rest of India. |

25th |

GST | ITC-04 for the period 01 April 2022 to 01 October 2022 in respect of principal whose aggregate turnover during FY2021-22 exceeds ₹ 5 crores. |

30th |

LLP | Form 8 Annual Account or Statement of Accounts for F.Y. 2021-22. |

31st |

GST | To opt-out or in from QRMP for the period October to December 2022. |

| TDS | TDS Quarterly Statements (Other than Government Deductor) for July to September 2022. | |

| Prof. Tax | Monthly Return Tax Liability of ₹ 1,00,000/- & above for September. | |

| Income Tax | TCS Quarterly Statements (Other than Government Deductor) for July to September 2022.

Due Date to furnish the audit report for transfer pricing regulations for F.Y. 2021-22. |

|

|

Software Solutions Available on: TDS | PAYROLL | WEB PAYROLL | WEB HRMS | XBRL | FIXED ASSET |INCOME TAX| SERVICE TAX | DIGITAL SIGNATURE | ATTENDANCE MACHINE & CCTV | DATA BACKUP SOFTWARE | PDF SIGNER |

||

|

Sensys Technologies Pvt. Ltd. HO: 904, 905 & 906, Corporate Annexe, Sonawala Road, Goregaon East, Mumbai- 400 063. |

||

What Does Offboarding Mean?

HR pays much attention to onboarding and performance management, but less focus is on streamlining your offboarding procedure. Offboarding, however, is crucial for upholding your company’s reputation, improving the working conditions for your present staff, and retaining networking opportunities.

Offboarding is the procedure that results in a formal breakup between a worker and a corporation via retirement, termination, or resignation. It includes every choice and action made during an employee’s departure. It may include:

- Transferring the duties of that employee’s position using the employee database management system

- Removing credentials and access rights with the help of HRM solutions

- Delivering the equipment

- Interviewing existing patrons to obtain comments

Additionally, you can learn from the process what you can do to make things better for your present and future employees.

What is the benefit of an exit interview?

1. It is cost-effective:- Exit interviews are unquestionably a great tool you can add to human resources because they don’t take up much time, cost little, and yield useful information. It’s also relatively simple to have a discussion or interview an employee to discuss the company’s strengths and flaws. It’s a tiny investment that will have a big payoff.

2. You will understand and come to know why people leave:- Finding out why people decide to quit your company will provide you with the information you need to address the problem. People will undoubtedly have different motivations; therefore, it’s essential to determine whether the company, management, or external factors are to blame. Possible reasons for the employee’s departure from their current position include receiving a job offer with a higher income elsewhere, failing to make the promised advancement, or having to deal with personal concerns. Knowing why someone departed will help you solve any problems and prevent them from happening again.

3. You will spot any issues with the company:- You want to grow your company if you’re considering holding an exit management process. People should want to work where you build it. Exit interviews provide the knowledge you need to increase employee retention and the working environment for employees. A lot of the inquiries made during a departure interview concern the workplace. Knowing how people under your management feel at work might be challenging.

4. Closure:- Exit interviews allow you to complete any outstanding business with a departing employee. You can talk to them about their reasons for leaving, their final salary, and any paperwork that needs to be finished by their last day, in addition to probing them about their decision. Additionally, it’s excellent if the company and employee can make amicably part ways. Even though an exit interview won’t tell you all you want to know, it’s a beautiful place to start understanding why people leave. Both existing and potential employees will have a better experience if you accept constructive comments and implement adjustments.

Components of a Successful Offboarding Program

- Management Buy-In: The most crucial element of a successful offboarding program is a leadership team that is receptive to the suggestions for improvement and feedback the program will elicit. The knowledge gleaned from exit interviews will amount to little more than time and effort wasted without support from the management team. Companies should establish an executive committee to oversee their program’s creation, implementation, and outcomes to reap the above benefits.

- Willingness to Change: A management’s desire to change and appreciation for employee feedback are indicated by their buy-in. Employees become disillusioned and start to think exit interviews are meaningless when they notice numerous coworkers leave for the same reasons, but nothing changes. Working for someone doesn’t thrill employees as much as working alongside them. An organization’s management team can develop collaboration and improve employee retention, morale, and performance by respecting and acting upon employee input.

- Share the Feedback from Exit Interviews: To share the feedback from departure interviews, it’s critical to have a consistent protocol in place. The HR department should consolidate and analyze all the data they learn through exit interviews and then regularly meet with the right stakeholders to deliver this data, along with any change recommendations. Depending on how many exit interviews are conducted at any given time, this meeting’s frequency may change. A weekly or monthly feedback meeting may be helpful during high turnover. If not, quarterly gatherings might be sufficient.

Frequently Asked Questions(FAQs)

Q1. Why is an exit interview important?

A. When appropriately done, exit interviews can offer a steady stream of hr payroll software, insightful feedback, and insight on each of the three fronts. They can raise employee engagement and retention by outlining what functions well or poorly within the company.

Q2. Who should do exit interviews?

A. The most typical option is to delegate it to an internal HR representative. They ought to be familiar with your organization’s participants and its dynamics. This enables them to delve farther into problems and poses more direct queries.

Q3. What happens during the exit interview?

A. An employee may be questioned about their reasons for leaving, their opinion of the business, and any advice they may have for revision during an exit interview. The ideal foundation for the discussion is a well-structured questionnaire.

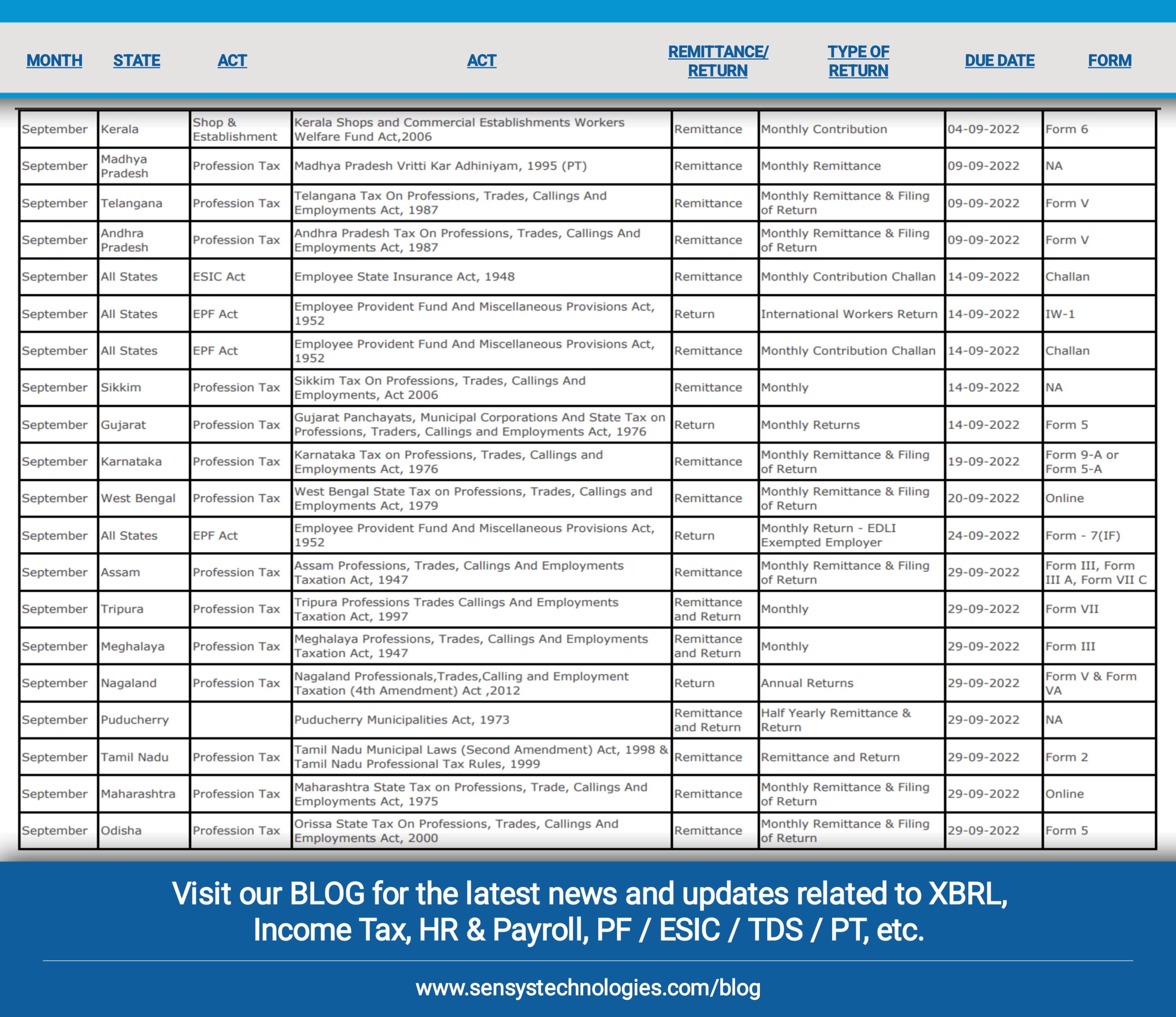

Appended below is the Pan India Compliance calendar for September 2022, employer is under obligation to contribute towards some of the above-mentioned compliances for the welfare of the employees. Each of these compliances is again governed by a set of rules and formulas. It is proven to be a deliberate attempt to violate the provisions of the law, there could be imprisonment of the employer. Please, comply with the same in time to avoid any future non-compliance so that hefty penalties and fines are not charged by the respective dept.

07th |

TDS | TDS Payment for August 2022. |

10th |

GST | Return for authorities deducting tax at source – GSTR 7 for August 2022. |

| Details of supplies effected through e-commerce operators and the amount of tax collected – GSTR 8 for August 2022. | ||

11th |

GST | Details of outward supplies of taxable goods and/or services effected – GSTR 1 for August 2022. |

13th |

GST | Invoice Furnishing Facility (IFF) for August 2022 instead of GSTR 1 for QRMP Filers. |

| Return for Input Service Distributor – GSTR 6 for August 2022. | ||

15th |

P.F. | P.F. Payment for August 2022. |

| ESIC | ESIC Payment for August 2022. | |

| Income Tax | Advance Tax 2nd Installment for F.Y. 2022-23. | |

20th |

GST | GSTR 3B for August 2022 if aggregate turnover is above ₹ 5 crore. |

| Return for Non-Resident foreign taxable persons – GSTR 5 for August 2022. | ||

22nd |

GST | GSTR 3B for August 2022 if aggregate turnover below ₹ 5 crores for Andaman & Nicobar Islands, Andhra Pradesh, Chhattisgarh, Dadra & Nagar Haveli, Gujarat, Goa, Karnataka, Kerala, Lakshadweep, Madhya Pradesh, Maharashtra, Puducherry, Tamil Nadu, Telangana. |

24th |

GST | GSTR 3B for August 2022 if turnover is below ₹ 5 crores for the Rest of India. |

25th |

GST | Monthly Payment for August 2022 through Challan PMT 06 for QRMP filers. |

30th |

Prof. Tax | Monthly Return Tax Liability of ₹ 1,00,000/- & above for August |

| Income Tax | Due Date for Filing Tax Audit Report for F.Y. 2021-22 | |

|

Software Solutions Available on: TDS | PAYROLL | WEB PAYROLL | WEB HRMS | XBRL | FIXED ASSET |INCOME TAX| SERVICE TAX | DIGITAL SIGNATURE | ATTENDANCE MACHINE & CCTV | DATA BACKUP SOFTWARE | PDF SIGNER |

||

|

Sensys Technologies Pvt. Ltd. HO: 904, 905 & 906, Corporate Annexe, Sonawala Road, Goregaon East, Mumbai- 400 063. |

||

07th |

TDS | TDS Payment for July 2022. |

10th |

GST | Return for authorities deducting tax at source – GSTR 7 for July 2022. |

| Details of supplies effected through e-commerce operators and the amount of tax collected – GSTR 8 for July 2022. | ||

11th |

GST | Details of outward supplies of taxable goods and/or services effected – GSTR 1 for July 2022. |

13th |

GST | Invoice Furnishing Facility (IFF) for July 2022 in lieu of GSTR 1 for QRMP Filers. |

| Return for Input Service Distributor – GSTR 6 for July 2022. | ||

15th |

P.F. | P.F. Payment for July 2022. |

| ESIC | ESIC Payment for July 2022. | |

20th |

GST | GSTR 3B for July 2022 if aggregate turnover above ₹ 5 crore. |

| Return for Non-Resident foreign taxable persons – GSTR 5 for July 2022. | ||

22nd |

GST | GSTR 3B for July 2022 if aggregate turnover below ₹ 5 crore for Andaman & Nicobar Islands, Andhra Pradesh, Chhattisgarh, Dadra & Nagar Haveli, Gujarat, Goa, Karnataka, Kerala, Lakshadweep, Madhya Pradesh, Maharashtra, Puducherry, Tamil Nadu, Telangana. |

24th |

GST | GSTR 3B for July 2022 if turnover below ₹ 5 crore for Rest of India. |

25th |

GST | Monthly Payment for July 2022 through Challan PMT 06 for QRMP filers. |

31st |

Prof. Tax | Monthly Return Tax Liability of ₹ 1,00,000/- & above for July 2022. |

|

Software Solutions Available on: TDS | PAYROLL | WEB PAYROLL | WEB HRMS | XBRL | FIXED ASSET |INCOME TAX| SERVICE TAX | DIGITAL SIGNATURE | ATTENDANCE MACHINE & CCTV | DATA BACKUP SOFTWARE | PDF SIGNER |

||

|

Sensys Technologies Pvt. Ltd. HO: 904, 905 & 906, Corporate Annexe, Sonawala Road, Goregaon East, Mumbai- 400 063. |

||

Appended below is the Pan India Compliance calendar for August 2022, employer is under obligation to contribute towards some of the above-mentioned compliances for the welfare of the employees. Each of these compliances is again governed by a set of rules and formulas. It is proven to be a deliberate attempt to violate the provisions of the law, there could be imprisonment of the employer. Please, comply with the same in time to avoid any future non-compliance so that hefty penalties and fines are not charged by the respective dept.

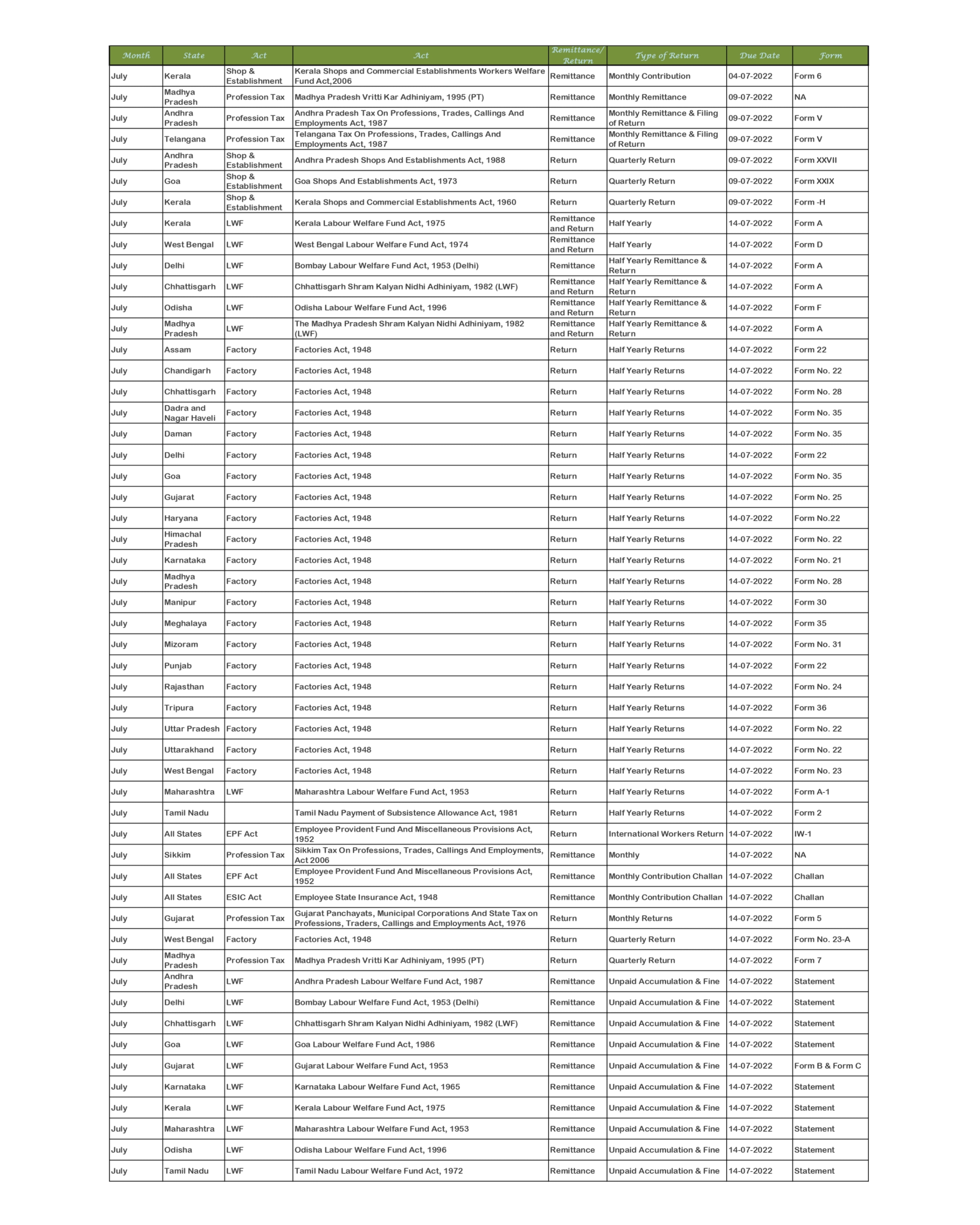

Appended below is the Pan India Compliance calendar for July 2022, employer is under obligation to contribute towards some of the above-mentioned compliances for the welfare of the employees. Each of these compliances is again governed by a set of rules and formulas. It is proven to be a deliberate attempt to violate the provisions of the law, there could be imprisonment of the employer. Please, comply with the same in time to avoid any future non-compliance so that hefty penalties and fines are not charged by the respective dept.

Appended below is the Pan India Compliance calendar for July 2022, employer is under obligation to contribute towards some of the above-mentioned compliances for the welfare of the employees. Each of these compliances is again governed by a set of rules and formulas. It is proven to be a deliberate attempt to violate the provisions of the law, there could be imprisonment of the employer. Please, comply with the same in time to avoid any future non-compliance so that hefty penalties and fines are not charged by the respective dept.